Enabling Variable Instalments

Many of the financial institutions using Finflux need greater flexibility and control around the repayments schedule to support agricultural loans and other products that are more suited to the cash flows of the borrower. New support for variable installment loans allows for the dates, amounts, and number of installments in the repayment schedule to be manually configured prior to loan approval.

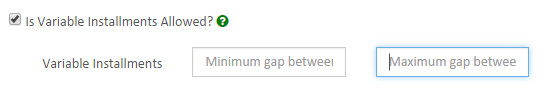

At the product level, one can now enable variable installments, and then specify the minimum and/or maximum gap that can be present between installments.

For each loan account with this setting enabled, the following can be manually configured in the repayment schedule prior to approving the loan:

- Adjust due dates of installments

- Add/remove installments

- Modify amount of the installments

On this page:

Create loan account with variable instalments

Go to Admin>>Product>>Loan Product>> Create Loan products

- Provide all the necessary fields for creating a Loan product, refer Loan Product Fields

- In the settings section, update below mentioned fields

a) Is variable instalments allowed - Check the check box to enable.

b) Minimum gap between days - Provide minimum number of days

c) Maximum gap between days - Provide maximum number of days

- Click Submit.

Related articles