How to create Saving Accounts

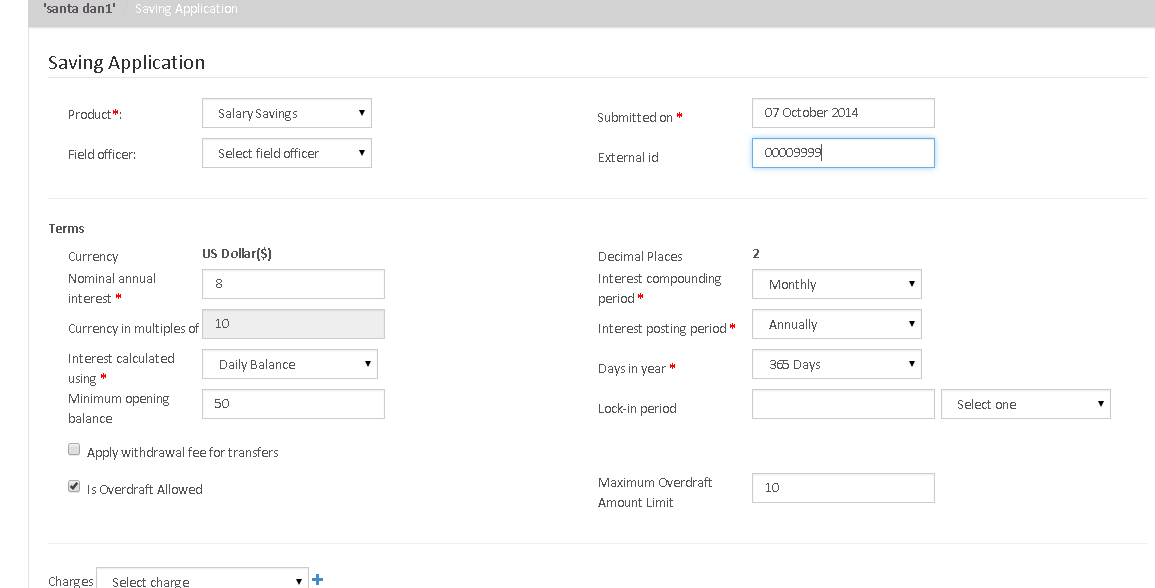

A saving account is an instance of a saving product. A saving account has a unique account number, a specified interest rate, external id, minimum opening balance and it is owned by either client or group.

A saving account can be created for an active client or group based on a saving product that is active on the submitted date. When a saving account is created, it inherits the rules and defaults from the saving product. Your financial institution may allow some of the inherited information to be modified for a saving account.

A client may have more than one active saving account as defined by a financial institution's policies, configured in the Product Mix.

The saving account actions / transactions availability and affect on the saving account life cycle status are:

| Previous Status | Action | Resulting Status |

|---|---|---|

| N/A | New Saving | Pending Approval |

| Pending Approval | Modify Application | Pending Approval |

| Add Saving Charge | Pending Approval | |

| Modify Application | Pending Approval | |

| Reject | Rejected(cancel) | |

| Assign Staff | Pending Approval | |

| Withdrawn by Client | Cancelled(withdrawn) | |

| Delete | Cancelled | |

| Approved | Undo Approval | Pending Approval |

| Activate | Saving Account Created | |

| Add saving charge | Approved | |

| Assign staff | Staff assigned(approved) | |

| Active | Add saving charge | Active |

| Deposit | Active | |

| Withdraw | Active, until the amount in saving account is greater than zero. | |

| Calculate Interest | Interest calculated and shown on the same window | |

| Unassign staff | Assign Staff | |

| Transfer Fund | throwing error: insufficient fund to transfer.. ?? | |

| Close | Withdraw balance and Saving Account is closed. |

The typical Saving Account overview is shown in below image with all above options mentioned in the table.

In the Saving Account overview, you can see Summary, Transactions and charges related to Savings Account.

Group Saving Account:

A group saving account is a single saving account shared by all members of a group. All the members of the group can perform deposit and withdraw operations. The group is treated collectively by the financial institution as a single entity.

Saving Account Transactions:

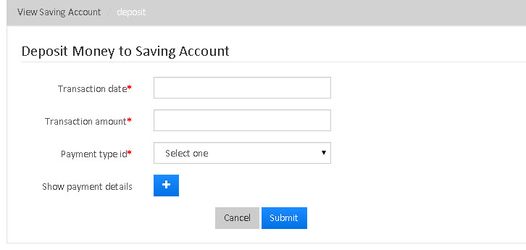

I) Deposit:

In order to deposit the amount for the Client's Saving Account:

1) Go to the Client's profile

2) Select the Savings Account and open it

3 ) Click on 'Deposit' tab, to see the following window:

4) Enter the Transaction Date, Amount and Payment Type

5) Click on the 'Submit' button to make the deposition.

6) Finally, go to the Savings Account overview and click on 'Transactions' tab to confirm the deposition.

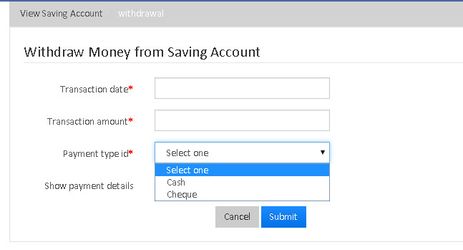

II) Withdraw:

In order to enable client to withdraw amount from Savings Account

1) In the Client's Saving Account overview click on 'Withdraw' tab to see the following window:

4) Enter the Transaction Date, Amount and Payment Type

5) Click on the 'Submit' button to make the withdrawal.

6) Finally, go to the Savings Account overview and click on 'Transactions' tab to confirm the withdrawal.