Credit Bureau Usage

Credit Bureau is included in the loan origination process (with or without workflow) which is supported by "New Loan Application" and not supported by new loan.

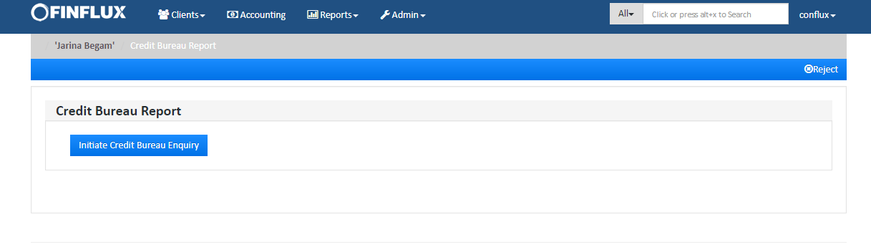

Step 1:Initiate Credit Bureau Enquiry

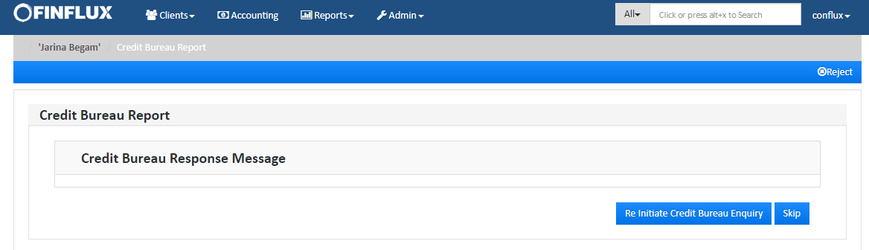

Step 2: If the credit bureau fails re-initiate or skip the credit bureau check.

Note: To skip credit bureau when it fails a check box "Skip credit check in the event of failure" should be enabled in Credit bureau check mapping definition.

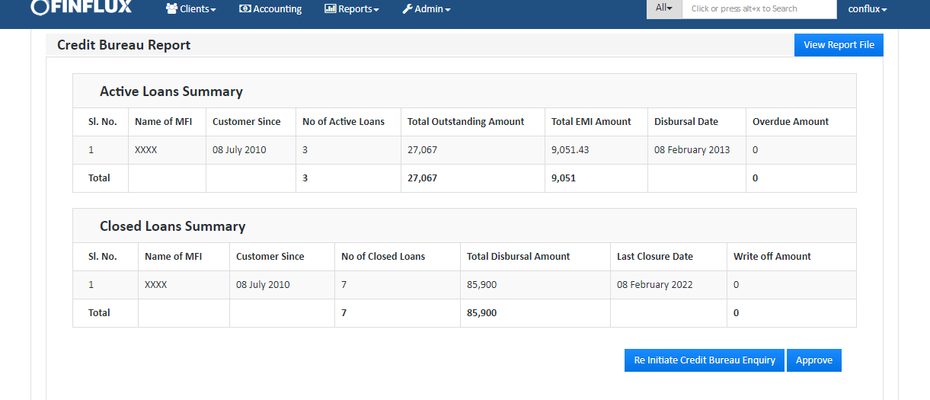

Step 3: Credit Bureau Check Result

1.High Mark Report

On successful initiation the result will be shown as in the fig below. Click on "View Report File" to View full credit bureau data with the respective credit bureau product (Highmark) report format.

If re-initiation is required click on "Re-Initiate Credit Bureau Enquiry" or click on approve button to approve the loan with credit bureau result.

Active Loan Summary Description

| # | Field name | Description |

|---|---|---|

| 1. | Name of MFI | Displays the list of MFI name from where the client has taken loan |

| 2. | Customer Since | Displays from when the client is customer of the particular MFI |

| 3. | No of Active Loans | Displays the number of active loans currently particular client have. |

| 4. | Total Outstanding Amount | Displays the total outstanding amount client has to repay. |

| 5. | Total EMI Amount | Displays Total EMI amount currently client suppose to pay |

| 6. | Disbursal Date | Displays the disbursal date for each loan the client took from each MFI |

| 7. | Overdue Amount | Displays overdue amount if any for a particular client to repay |

Closed Loans Summary Description

| # | Field name | Description |

|---|---|---|

| 1. | Name of MFI | Displays the list of MFI name from where the client has taken loan |

| 2. | Customer Since | Displays from when the client is customer of the particular MFI |

| 3. | No of closed Loans | Displays the number of closed loans by the client. |

| 4. | Total Disbursal Amount | Displays the total disbursed amount under each MFI. |

| 5. | Last Closure Date | Displays the recently closed loan date. |

| 6. | Write off Amount | Displays the written-off amount if any |

2.Equifax Report

On successful initiation the result will be shown as in the fig below. Click on "View Report File" to View full credit bureau data with the respective credit bureau product (Equifax) report format.

If re-initiation is required click on "Re-Initiate Credit Bureau Enquiry" or click on approve button to approve the loan with credit bureau result.

Active Loan Summary Description

| # | Field name | Description |

|---|---|---|

| 1. | Name of MFI | Displays the list of MFI name from where the client has taken loan |

| 2. | Customer Since | Displays from when the client is customer of the particular MFI |

| 3. | No of Active Loans | Displays the number of active loans currently particular client have. |

| 4. | Total Outstanding Amount | Displays the total outstanding amount client has to repay. |

| 5. | Total EMI Amount | Displays Total EMI amount currently client suppose to pay |

| 6. | Disbursal Date | Displays the disbursal date for each loan the client took from each MFI |

| 7. | Overdue Amount | Displays overdue amount if any for a particular client to repay |

Closed Loans Summary Description

| # | Field name | Description |

|---|---|---|

| 1. | Name of MFI | Displays the list of MFI name from where the client has taken loan |

| 2. | Customer Since | Displays from when the client is customer of the particular MFI |

| 3. | No of closed Loans | Displays the number of closed loans by the client. |

| 4. | Total Disbursal Amount | Displays the total disbursed amount under each MFI. |

| 5. | Last Closure Date | Displays the recently closed loan date. |

| 6. | Write off Amount | Displays the written-off amount if any |

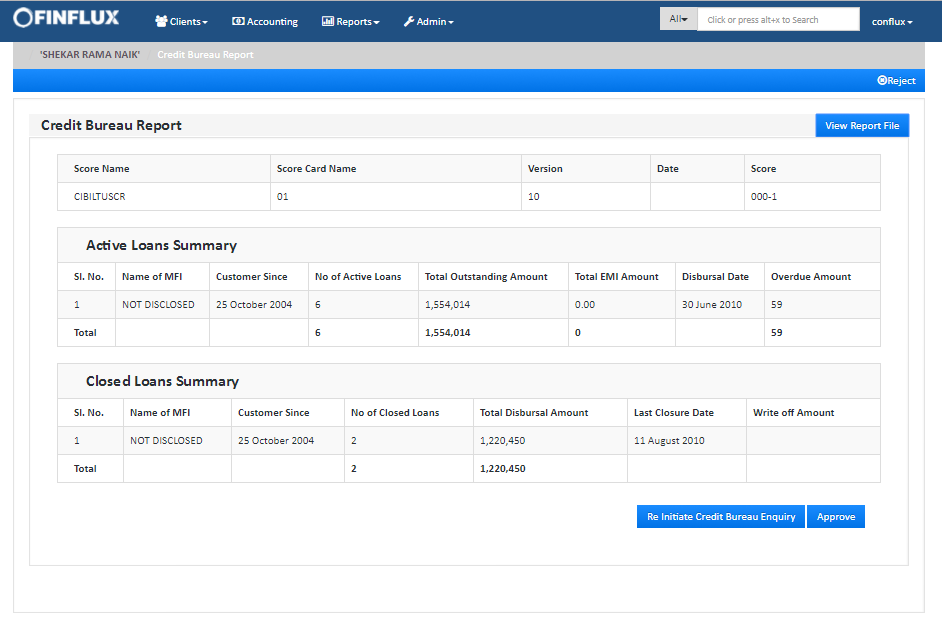

3.Cibil Report

On successful initiation the result will be shown as in the fig below. Click on "View Report File" to View full credit bureau data with the respective credit bureau product (Cibil) report format.

If re-initiation is required click on "Re-Initiate Credit Bureau Enquiry" or click on approve button to approve the loan with credit bureau result.

CIBIL Specific Data Description

| # | Field name | Description |

|---|---|---|

| 1. | Score Name | Score Name as per CIBIL Definition |

| 2. | Score Card Name | Score Card Name as per CIBIL Definition |

| 3. | Version | Version number as per CIBIL |

| 4. | Date | Shows the date |

| 5. | Score | Score as per CIBIL analysis |

Active Loan Summary Description

| # | Field name | Description |

|---|---|---|

| 1. | Name of MFI | Displays the list of MFI name from where the client has taken loan |

| 2. | Customer Since | Displays from when the client is customer of the particular MFI |

| 3. | No of Active Loans | Displays the number of active loans currently particular client have. |

| 4. | Total Outstanding Amount | Displays the total outstanding amount client has to repay. |

| 5. | Total EMI Amount | Displays Total EMI amount currently client suppose to pay |

| 6. | Disbursal Date | Displays the disbursal date for each loan the client took from each MFI |

| 7. | Overdue Amount | Displays overdue amount if any for a particular client to repay |

Closed Loans Summary Description

| # | Field name | Description |

|---|---|---|

| 1. | Name of MFI | Displays the list of MFI name from where the client has taken loan |

| 2. | Customer Since | Displays from when the client is customer of the particular MFI |

| 3. | No of closed Loans | Displays the number of closed loans by the client. |

| 4. | Total Disbursal Amount | Displays the total disbursed amount under each MFI. |

| 5. | Last Closure Date | Displays the recently closed loan date. |

| 6. | Write off Amount | Displays the written-off amount if any |

Note