Manage Fund

Important Terms

| # | Fund Category | Description |

|---|---|---|

| 1. | Buyout | In finance, a buyout is an investment transaction by which the ownership equity of a company, or a majority share of the stock of the company is acquired. The acquirer thereby "buys out" the present equity holders of the target company. A buyout will often include the purchasing of the target company's outstanding debt, which is referred to as "assumed debt" by the purchaser. The target company's outstanding debt also can be clients who fall under outstanding loan. In the same way these clients will be purchased by the Bank. This is a permanent purchase of a set or group of clients. The fund source will not be reassigned back to the parent fund source. For Example: Sanjeevan MFI has a loan portfolio of 10 crores and State Bank of India is having illiquid asset(meaning no proper transaction which results in dead amount which is not utilized). To have a proper financial liquidity State Bank of India purchases 10 crore of loan portfolio from Sanjeevan MFI. Hence the process of purchasing the loan portfolio is one of the best example of Buyout where the loan portfolio will be sold permanently to the other organization. |

| 2. | Temporary (term) | Term based or temporary fund assignment is another way of purchasing the clients but for a defined tenure. It's not a permanent purchase, but it's a temporary purchase of clients who are under outstanding loan. After the maturity of the term, the fund source will be reassigned back to the parent fund source. |

| 3. | Own | Own Fund Source means the fund is from organization itself not from any other source. |

| 4. | Securitization | Securitization is the process of taking an illiquid asset, or group of assets, and through financial engineering, transforming them into a security. A typical example of securitization is a mortgage-backed security (MBS), which is a type of asset-backed security that is secured by a collection of mortgages. |

| 5. | Term Loan | A term loan is a monetary loan that is repaid in regular payments over a set period of time. A term loan usually involves an unfixed interest rate that will add additional balance to be repaid. |

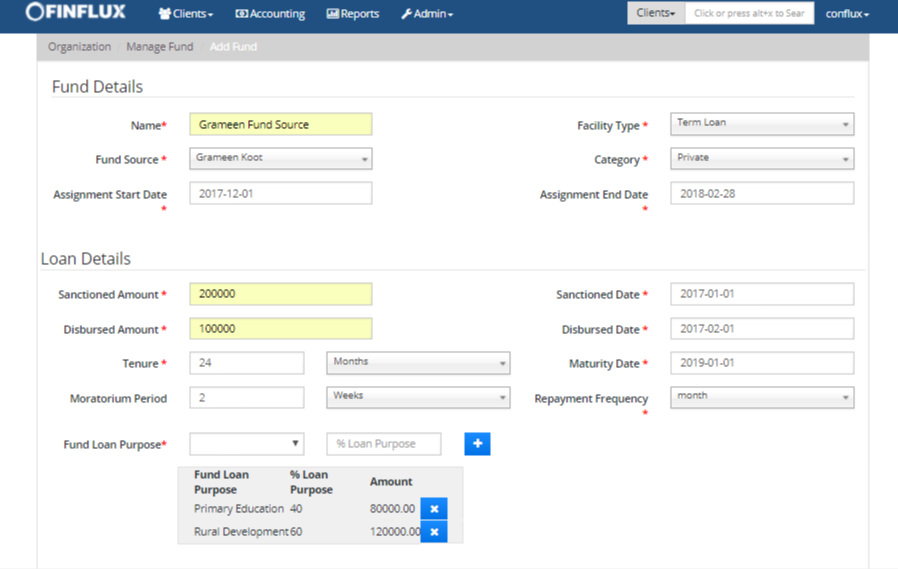

Follow the following steps to add fund

Step 1: Navigate to Admin>>Organization>>Manage Fund and click on Add Fund to add new funds

| # | Field Name | Description |

|---|---|---|

| Fund Details | ||

| 1. | Name | Provide fund name |

| 2. | Facility Type | Select the facility type from the drop down. |

| 3. | Fund Source | Select the fund source from the drop down. (To add fund source add code values in admin>>System>>Manage Codes >>fundsource) |

| 4. | Category | Select the category from the drop down. (To add category add code values in admin>>System>>Manage Codes >>category) |

| 5. | Assignment Start Date | Provide assignment start date |

| 6. | Assignment End Date | Provide assignment end date |

| Loan Details | ||

| 7. | Sanctioned Amount | Provide sanction amount for the organization from the mentioned fund |

| 8. | Sanctioned Date | Provide sanction date for the organization from the mentioned fund |

| 9. | Disbursed Amount | Provide disbursed amount for the organization from the mentioned fund |

| 10. | Disbursed Date | Provide disbursed date for the organization from the mentioned fund |

| 11. | Tenure | Provide tenure for the organization from the mentioned fund |

| 12. | Maturity Date | Provide maturity date for the organization from the mentioned fund |

| 13. | Moratorium Period | Provide moratorium for the organization from the mentioned fund |

| 14. | Repayment Fequency | Provide repayment frequency for the organization from the mentioned fund |

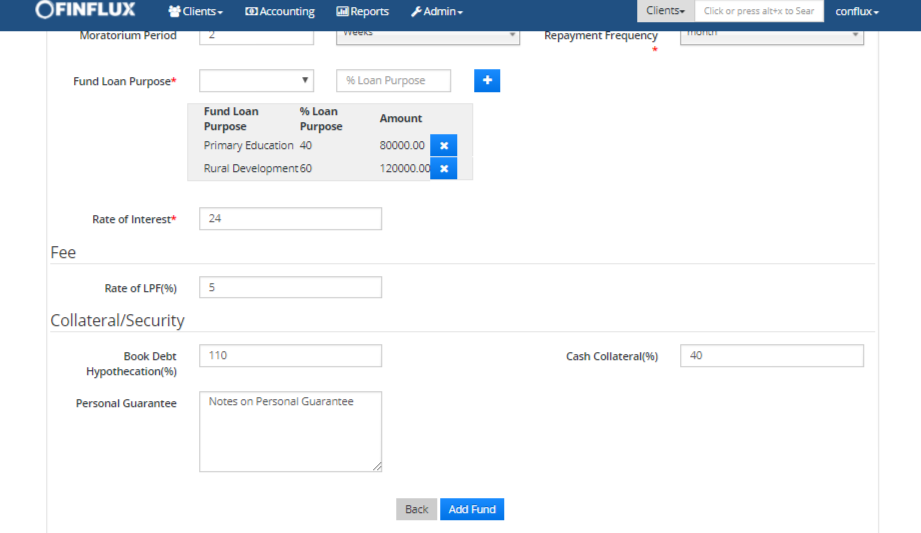

| 15. | Fund Loan Purpose | select the fund purpose and associated amount splits |

| 16. | Rate Of Interest | Provide rate of interest for the organization from the mentioned fund |

| Fee | ||

| 17. | Rate of LPF(%) | Provide percentage of loan portfolio fee for the organization from the mentioned fund |

| Collateral/Security | ||

| 18. | Book Debt Hypothecation(%) | Provide percentage of book debt hypothecation by the organization for the mentioned fund |

| 19. | Cash Collateral(%) | Provide percentage of cash collaterals by the organization for the mentioned fund |

| 20. | Personal Guarantee | Provide personal guarantee provided by the organization for the mentioned fund |