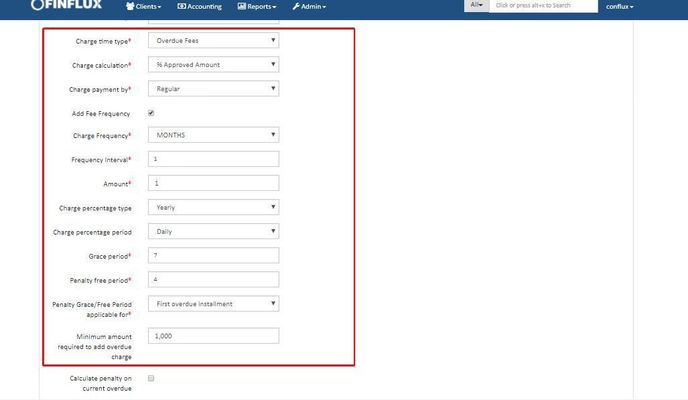

Overdue Charge Specific Fields

Fig 1: Overdue Fee specific fields

The description for charge calculation w.r.t Overdue Fees is as in the table below

| # | Charge Calculation | Description |

|---|---|---|

| 1. | Flat | Select Flat as charge calculation to charge flat amount. |

| 2. | % Approved Amount | Select % Approved Amount as charge calculation to calculate the charge amount based on the % of approved amount. (Principal due) |

| 3. | % Loan Amount + Interest | Select % Loan Amount + Interest as charge calculation to calculate the charge amount based on the % of sum of loan amount and interest. (Principal Due+Interest Due) |

| 4. | % Interest | Select % Interest as charge calculation to calculate the charge amount based on the % of interest amount. (Interest Due) |

| 5. | % Disbursement Amount | Select % Disbursement Amount as charge calculation to calculate the charge amount based on the % of disbursement amount.(% Disbursement Amount) |

| 6. | Slab Based | Select Slab Based as charge calculation to calculate the charge amount based on the slab (with respective repayments number and Installment amount). Refer Slab Based Charge for more info |

| 7. | %(Loan Amount + Interest + Fees) | Select %(Loan Amount + Interest + Fees) as charge calculation to calculate the charge amount based on the % of sum of loan amount, interest and fees.(Principal Due+Interest Due+Fees Due) |

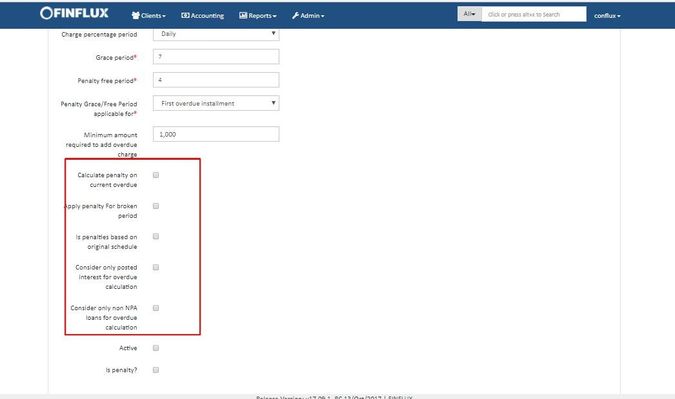

Fig 2: Overdue Fee specific fields

| # | Overdue Charge Specific Field Name | Description |

|---|---|---|

| 1. | Add Fee Frequency | Enable this checkbox to apply fee frequency. |

| 2. | Charge Frequency | This field is enabled on enabling "Add Fee Frequency". Following are the drop down options based on which the charge will be applied. 1. Days - It will divide the amount by 365 days (harge ) |

| 3. | Charge Percentage Type | 1. FLAT |

| 4. | Grace period | Grace period is nothing but waiting period to apply the penalty.

|

| 5. | Penalty free period | Penalty free period is nothing but a period of time the client will be benefited without penalty even though the client has overdue.

|

| 6. | Penalty Grace/Free Period applicable forCase | 1. Apply for First Overdue Installment

2. Apply for each Installment Case 2: When the Penalty free Period is defined (for ex "4 days")

|

| 7. | Apply penalty For broken period | When ever early or late repayments are done, with respect to the number of late/early days system calculates and applies the penalty. Note: Penalty will be applied irrespective of running overdue jobs Say for an example the repayment is on 01 February 2017,but the repayment is done on 15 February 2017. For the first 15 days(number of late repayment days), the system will calculate penalty for 10000(principal) amount later it will caculate for the remaning amount. |

| 8. | Charge Period Type | 1. Daily The charge amount will be divide by 365 days 2. Same as Frequency The charge amount will apply based on the frequency Ex: If any early repayment or late repayment is done, then the system will calculate the penalty based on the average balance |

| 9. | Is penalties based on original schedule | This is specific to NABKISAN Here Penalty will be calculate based on the Original Schedule |

| 10. | Consider only posted interest for overdue calculation | This is Specific to NABKISAN Precondition is : Principle grace should be applied Here for principle grace installments, the system will take posted interest to calculate the penalty when a charge with %ApprovedAmount+Interest is created, |

| 11. | Calculate penalty on current overdue | Disable : When ever early or late repayment are done, the system will calculate penalty based on the average balance of the loan amount Say for an example, First repayment is on 01 February 2017, If we do repayment on 15 February 2017 for 1st 15 days, the system will calculate penalty for 10000(principal amount) and for remaining days it will calculate penalty based on the average balance Enable : It will caluclate the penalty based on the current outstanding. |

| 12. | Consider only non NPA loans for overdue calculation | The overdue charge will be calculated only for the non NPA loans amount if this is enabled |