Deposit Accounts

A Deposit Account is an instance of a Deposit product. A Deposit Account has a unique account number, an interest rate depending on the term and it is owned by the client.

A Deposit account can be created for an active client based on a deposit product that is active on the submitted date. When a deposit account is created, it inherits the rules and defaults from the deposit product. Your financial institution may allow some of the inherited information to be modified for a deposit account, depending on how the deposit product is defined.

Deposit Account can be created for

- Fixed Deposit Product(FD Product)

- Recurring Deposit Product(RD Product)

On this page:

- Deposit Account For Fixed Deposit Product:

1. Go to the Clients List and select any Client to whom FD account needs to be created.

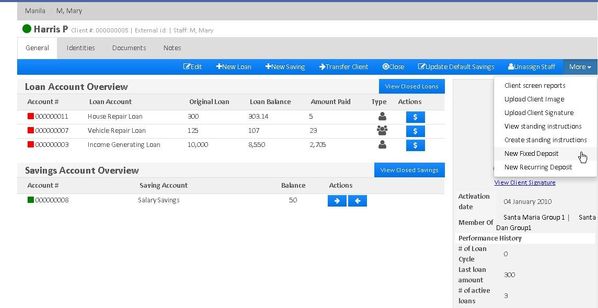

2. In the Client's profile, Go to 'More' option and click on 'New Fixed Deposit'

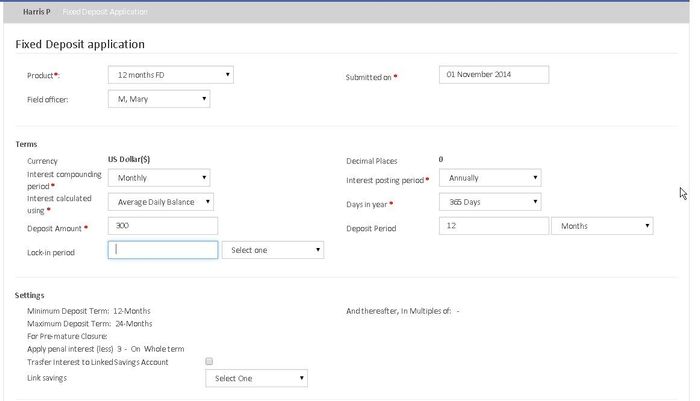

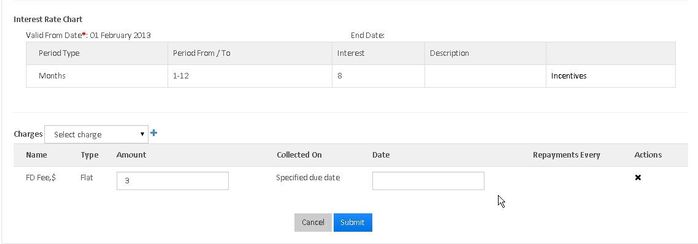

3. After clicking on 'New Fixed Deposit', Fixed Deposit Application will open as shown below.

| Field Name | Description | Example | Validations |

|---|---|---|---|

| Submitted On | Enter the FD Application Submitted Date by the Client | ||

| Deposit Amount | Enter the Deposit Amount (It Should be in between minimum and maximum deposit amount provided in FD product | ||

| Deposit Period | Provide the duration of the deposition | ||

| Locking Period | The amount can be locked for given period during which withdrawal or premature closure of FD Account is not possible. | ||

| Link Savings | Once the FD reaches to maturity , the interest can be posted to given savings account. |

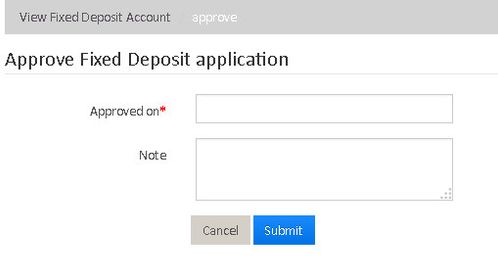

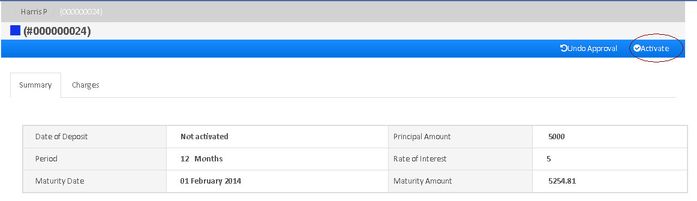

4. Once all the details are entered in FD application and submitted, it needs to be approved with date.

5. Finally, the FD account needs to be activated with specified date.

See how to create Recurring Deposit Account

Related articles

Filter by label

There are no items with the selected labels at this time.