GST setup using Tax-Configuration

1.Tax Configuration Setup

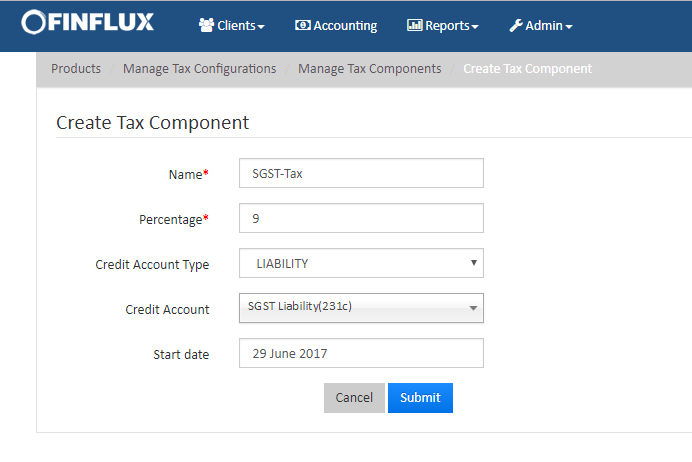

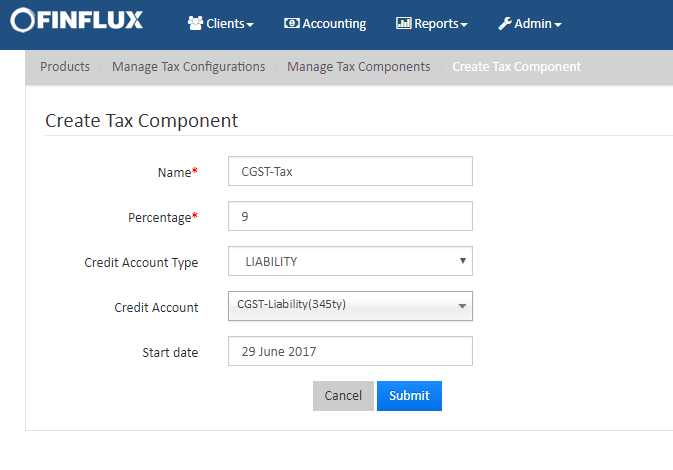

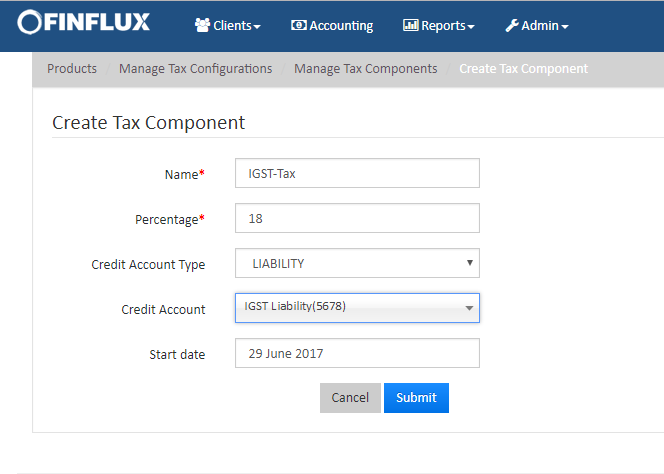

Step1: Create SGST, CGST and IGST as Tax components (Navigate to Admin>>Product>>Manage Tax Configuration>>Manage Tax Components) as shown in fig 1.1, fig 1.2 and fig 1.3 respectively where assumed rates would be 9% for CGST and SGST and 18% for IGST.

Fig 1.1. SGST Tax Component

Fig 1.2. CGST Tax Component

Fig 1.3. IGST Tax Component

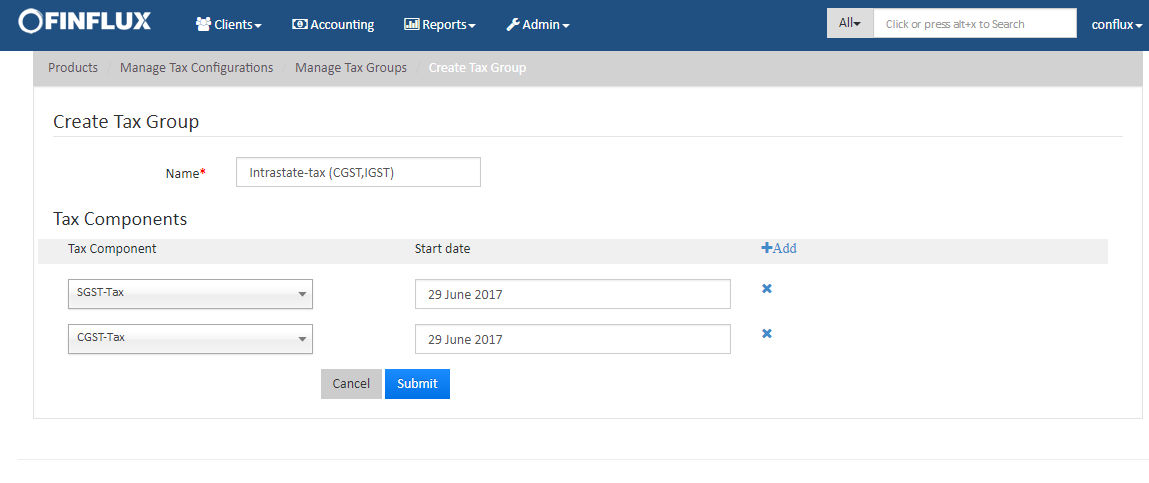

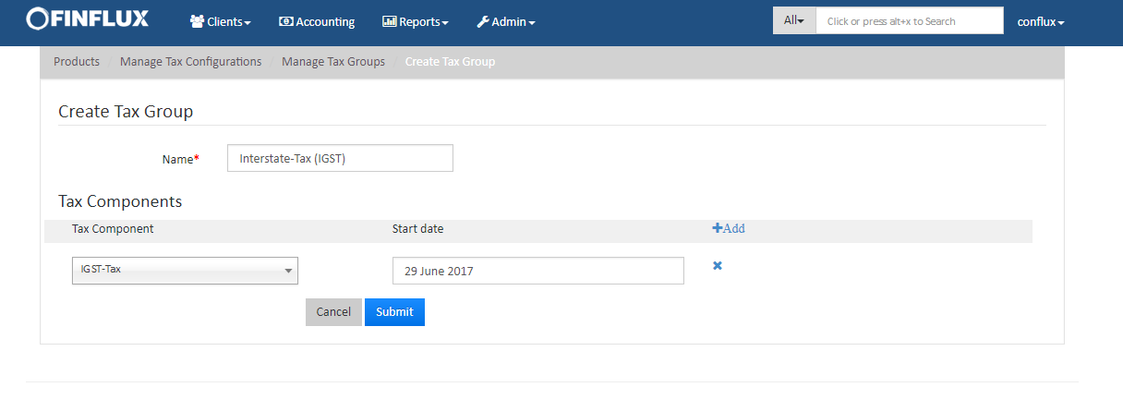

Step 2: Add tax components for Intrastate and Interstate GST rates in tax group as in fig 2.1 and Fig 2.2 by clicking on Add button.

Fig 1.4: Intrastate Tax settings

Fig 1.5: Interstate Tax settings

2. Charge Setup

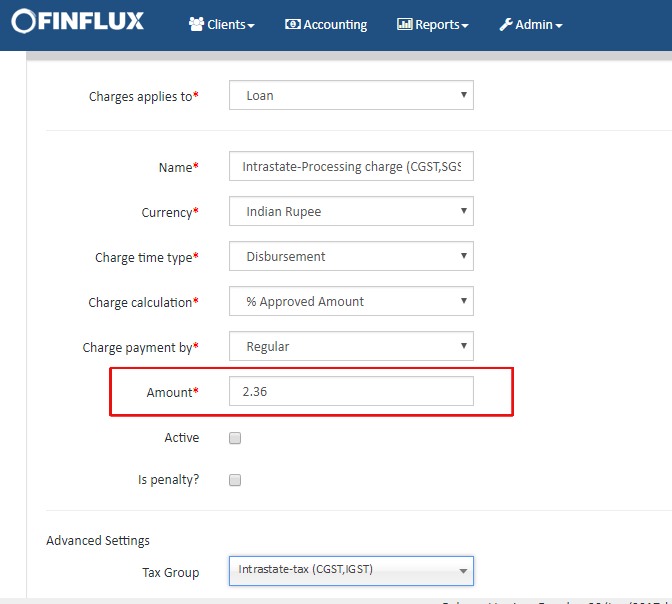

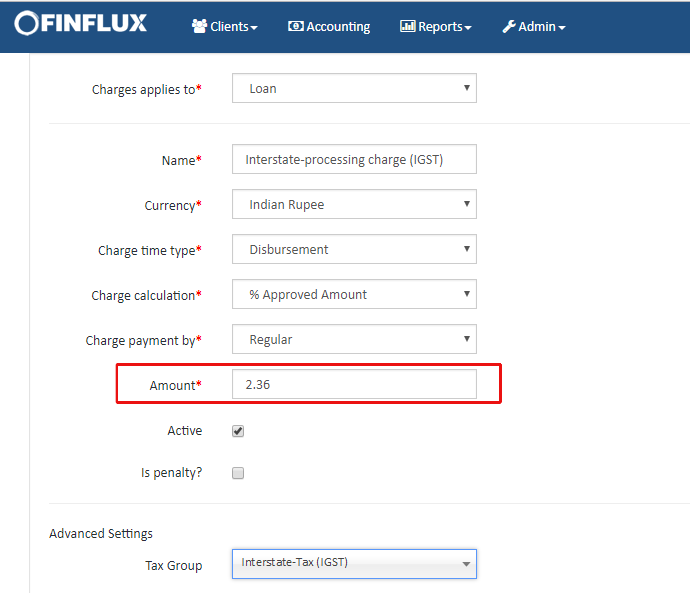

Step 1: Provide all the charge details as shown in the fig 2.1 and Fig 2.2 for Interstate and Intrastate charge separately.

Note:

- For and instance CGST rate = 9% and SGST rate = 9% and rate of disbursal fee is 2%. The CGST and SGST is inclusive to the charge and it will be taken as 9%(0.09) each. Hence for 1% of interest the amount should be defined as (1+.09+.09 = 1.18 i.e. disbursal fee+CGST rate+SGST rate). Similarly for 2% would be defined as (2+0.18+0.18=2.36). Hence can use the general formula as Rate of Actual fee+(Rate of Actual fee rate*CGST rate)+(Rate of Actual fee rate*SGST rate).

- For and instance IGST rate = 18% and rate of disbursal fee is 2%. The IGST is inclusive to the charge and it will be taken as 18%(0.18) each. Hence for 1% of interest the amount should be defined as (1+.18 = 1.18 i.e. disbursal fee+IGST rate). Similarly for 2% would be defined as (2+0.36=2.36). Hence can use the general formula as Rate of Actual fee+(Rate of Actual fee*IGST rate).

This would give a split-up of amounts as shown in fig 3.1 and fig 3.2

Fig 2.1: Intrastate charge configuration

Fig 2.2: Interstate charge configuration

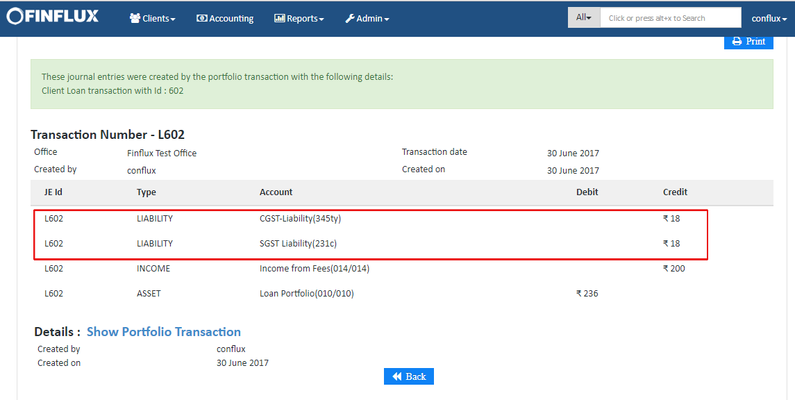

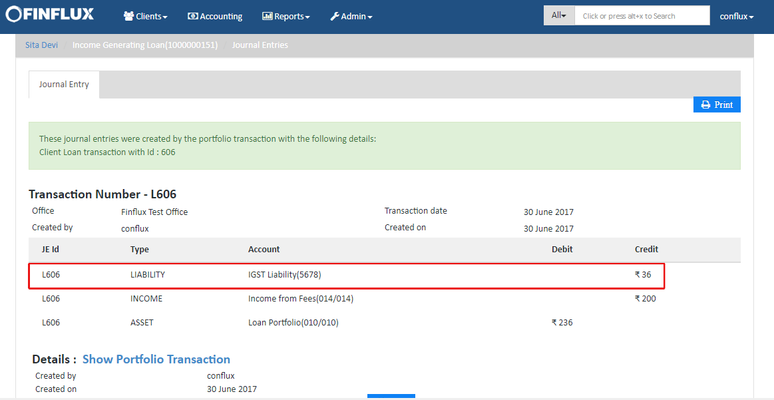

3. Journal Entry

Once the charge configuration is done add the charge in the loan product or account which would give the Journal entries as shown in Intrastate and Interstate Journal entries where the amount split-up will be shown.

Note: For an instance the loan amount disbursed is 10000 and hence the split-ups for actual fee and tax is as below

- Intrastate split-ups: Actual fee = 2% of loan amount would give 200, CGST = 9% of Actual Fee would give 18, SGST = 9% of Actual Fee would give 18

- Interstate split-ups: Actual fee = 2% of loan amount would give 200, IGST = 18% of Actual Fee would give 36

Fig 3.1: Journal Entry for Intrastate transaction

Fig 3.2: Journal Entry for Interstate transaction