Manage Tax configuration

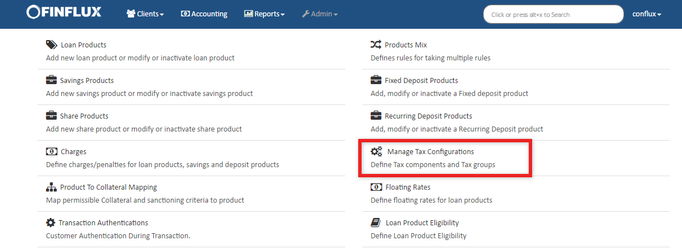

Beginning at the main screen, select Admin, then Products from the drop-down menu. This will launch the Products menu.

Select Manage Tax configuration.

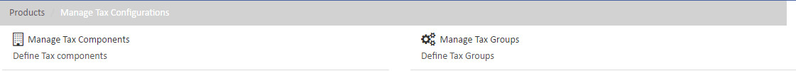

View Manage Tax configuration

Manage Tax Components

Create Tax Components

Click on +create tax components button

1 - Provide Name - Is the tax name

2 - Provide percentage - Is the tax percentage name

3 - Select Credit account type - Is the account type to be selected, if you are enabling accounting module then you need to select this field.

4 - Credit Account - Is the account name to be selected, you should have defined account in the Chart of Accounts - General Ledger Setup.

5 - Start Date - Provide start date.

6 - Click on Submit button.

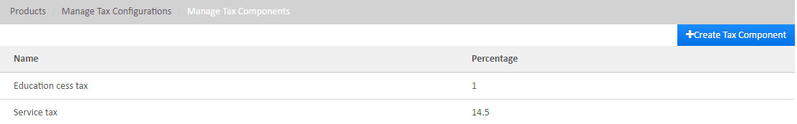

View tax components

Products>>Manage tax configuration>>Manage tax components

Edit tax components

Products>>Manage tax configuration>>Manage tax components>> View tax component

Manage Tax Groups

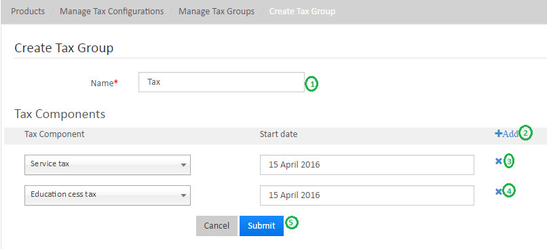

Create Tax Group

Click on +Create tax group

1 - Provide Name - Is the tax group name to be provided.

2 - Click on Add button - on clicking on Add button, will add tax component field for selection. In the above shown example 3 & 4 are new tax components added.

3 - Select Tax component & provide date. In the shown example create tax component - service tax is being shown for selection.

4 - Select Tax component & provide date. In the shown example create tax component - education cess tax is being shown for selection.

5 - Click on Submit button.

Applying tax

Tips:- Only Tax group can be applied not the tax component and You could apply tax group for Savings product, Recurring deposit product & Fixed deposit product.

Product level configuration

In Savings/Recurring/Fixed product under Settings section

1 - Check the check box for Is withhold tax applicable, if you want to enable & apply tax group.

2 - Tax group - Select required/defined tax group from the selection list.

3 - Click on Submit button.

Account level configuration

Step 1 - Fill all the required fields for creating savings account :- How to create Saving Accounts

Step 2 - In Savings/Recurring/Fixed product under Settings section

1 - Check the check box for Is withhold tax applicable, if you want to enable & apply tax group.

2 - Tax group - Select required/defined tax group from the selection list.

3 - Click on Submit button.

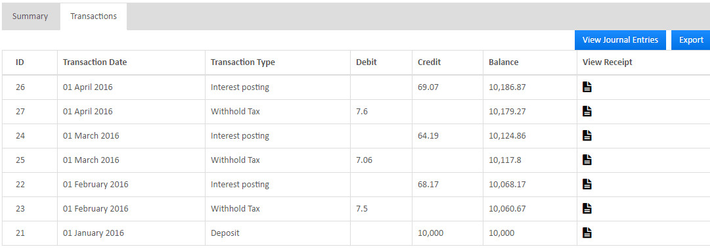

Reviewing tax collection

Once the interest posting happens, tax gets collected on the interest amount.

Note:- Tax is collected on the interest posted not on the entire amount.

Below shown is an example of the interested posted and collected tax scenario.

Related articles