Share products

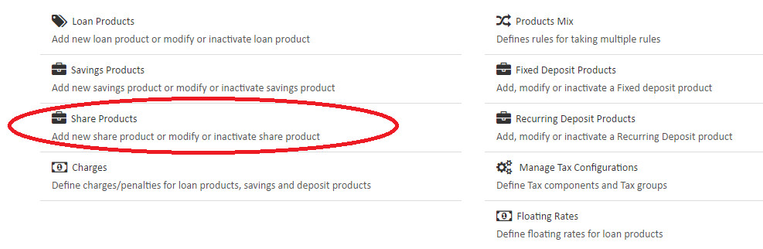

Beginning at the main screen, select Admin, then Products from the drop-down menu. This will launch the Products menu.

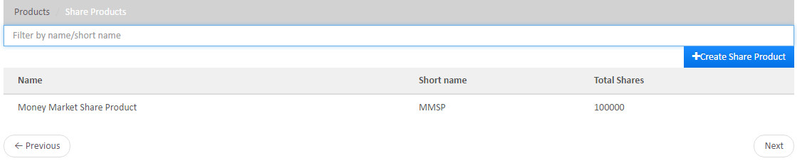

Select Share Products.

Create Share Product

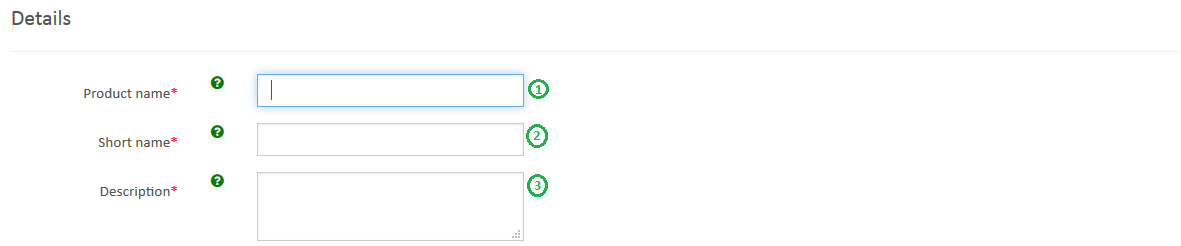

Details

- 1 - Provide Savings Product name .

- 2 - Provide Short name.

- 3 - Provide Description of this product.

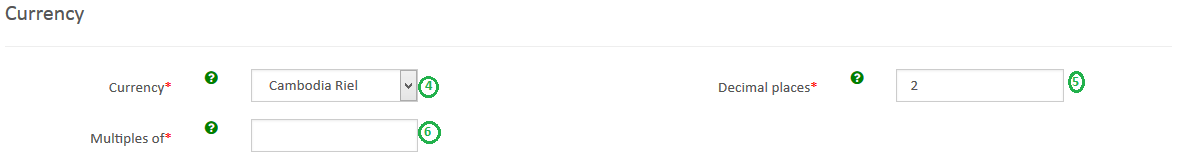

Currency

- 4 - Select Currency. Need to have defined required currency: Currency Configuration

- 5 - Provide Decimal places.

- 6 - Provide Currency in multiples of. This is to provide total amount rounding off. For ex: 10, so Total amount gets rounded of to 10's.

Terms

- 4 - Provide Total Number of Share - Is the total number of shares.

- 5 - Provide Shares to be issued - Is the numbers of shares to be issued.

- 6 - Provide Nominal Price - Is the per share price value.

- 7 - Info greyied field Capital value - Is the Per share price * Shares to issued.

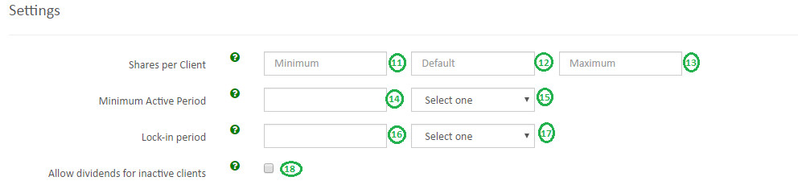

Settings

- 11 - Provide Shares per client - Minimum value

- 12 - Provide Shares per client - Default value

- 13 - Provide Shares per client - Maximum value

- 14 - Provide Minimum active period - Is the minimum number of period to be active in either to receive dividends.

- 15 - Select Period - For now it's only has Days to be selected.

- 16 - Provide Lock-in period - This is to set lock-in period hence withdrawal wont be allowed for the selected period.

- 17 - Select Period - Days or Weeks or Months

- 18 - Allow dividends for inactive clients - Check the check box if you want to enable to provide dividends to clients although they are inactive status. On enabling this dividend will only be provided only once, i.e for example client bought share on 1st Jan,2015 and redeemed(sold) it on 31st June, 2015. And organization declared dividend on 1 August, 2015 so he will get the dividend although he is in inactive status and only for once.

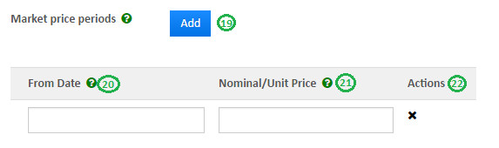

Market price

- 19 - Click on Add - To add & define market price for a period

- 20 - Select From Date - Is the date from which provided unit price is applicable, ex - 05/01/2016

- 21 - Nominal/Unit price - Provide unit price, ex - 5

- 22 - x - Is to remove the period & date.

In the above example here from date 05/01/2016 applicable per share is 5 & suppose if there was one more chart was defined with from date as 05/05/2016 with per share as 7 then depeninding upon the period share price is applicable.

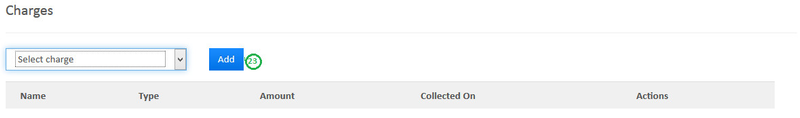

Charges

In either to use Add charge, you should have already defined it in charges. For more information on charges refer here: Charges

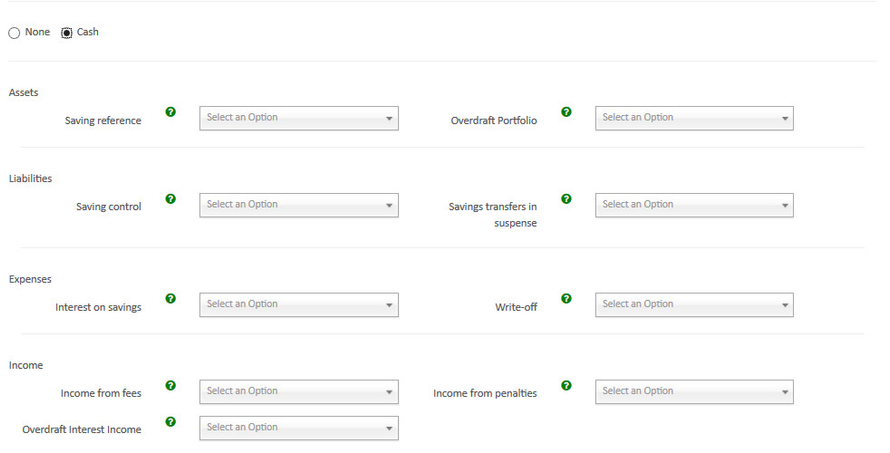

Accounting

- Cash

>> Map accounts with respect to the savings product accounts. For information on these accounts refer: A Possible accounting Spec - Accounting rules for savings.

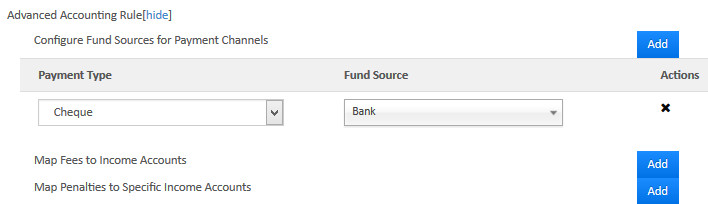

Advanced Accounting Rule

On clicking on the show button it enables Advanced accounting rule.

If you click on Add button, it will expand and shows up selection drop-downs.

- Configure Fund sources for Payment Channels.

Ex: In the above shown image, Payment type - Cheque is mapped to Fund source - Bank. So whenever payment type is used for transaction. Journal entry for Account - Bank will be passed. - Map Fees to Income Accounts.

- Map Penalties to Specific Income Accounts

Click on Submit button to Save/Create savings product.

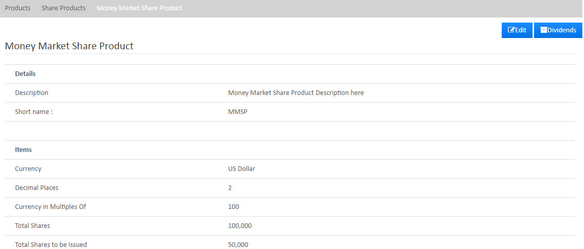

View Share Product

Go to Admin>>Product>>Share Product

Edit share Product

Go to Admin>>Product>>share Products>>Select share product (Ex: Money market share product) >> then click on Edit button.

For dividends refer link - Dividends

For spec refer - Share Account Management and Dividend Payment