Introduction to Accounting in Finflux

Configurable Chart of Accounts

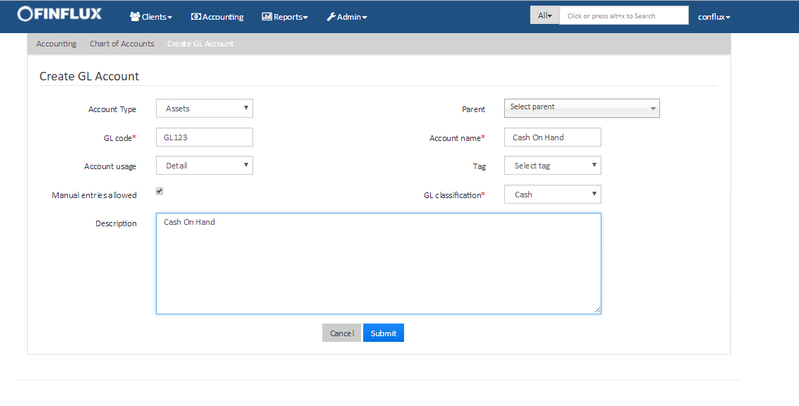

Create a General Ledger account

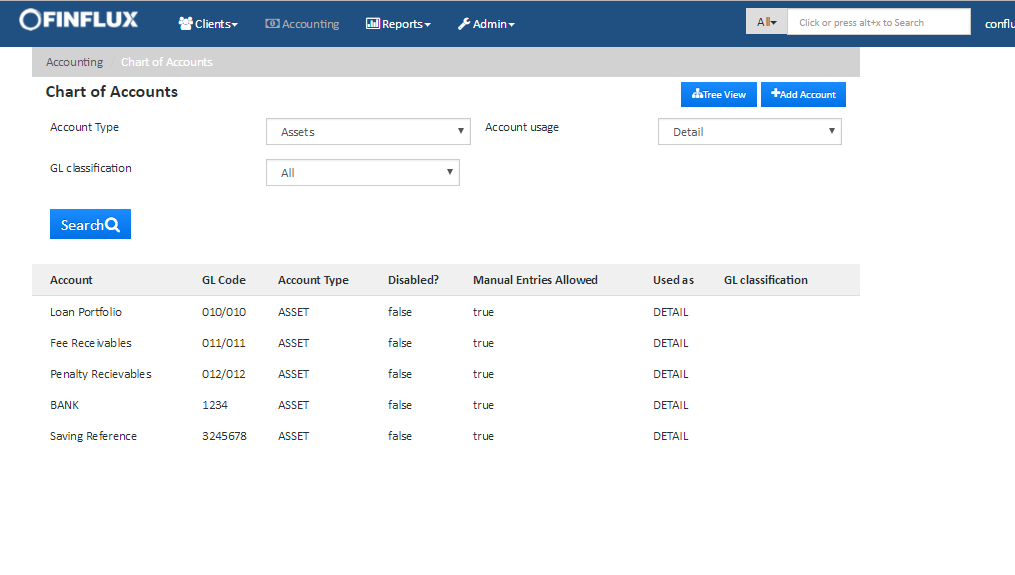

Searching for accounts in Finflux in a List View

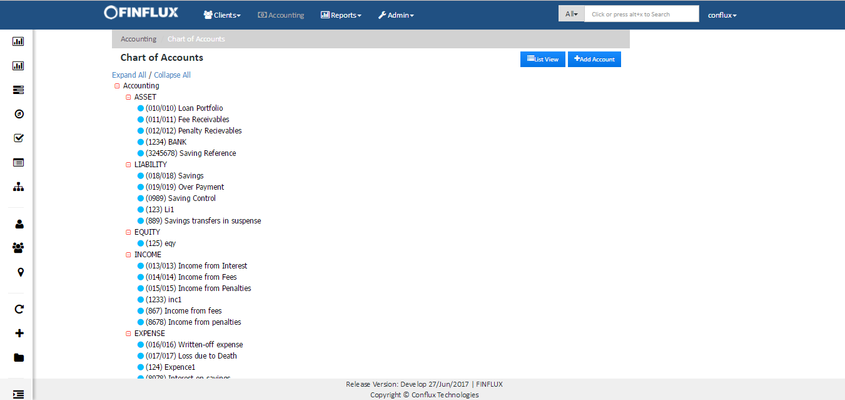

Chart Of Account Tree View

Finflux supports creating your custom chart of accounts as described in Chart of Accounts - General Ledger Setup.

New accounts can be added as either "header" or "detail" accounts.

"Header" accounts are used purely for grouping together related accounts, an organization would not log journal entries against the same (journal entry screens would not list "Header" accounts)

The COA is defined at an organization level and accounting reports are run at the branch level

- Finflux associates all journal entries to the branch which owns the entity that caused the entry (Ex: Loan account on which a disbursal occurred)

- All user defined journal entries are also associated with a branch

Cheat sheet for the behaviour of different accounts is as follows

| Account | Debit | Credit |

|---|---|---|

| Asset | Increase | Decrease |

| Liability | Decrease | Increase |

| Equity | Decrease | Increase |

| Income | Decrease | Increase |

| Expenditure | Increase | Decrease |

Journal Entries

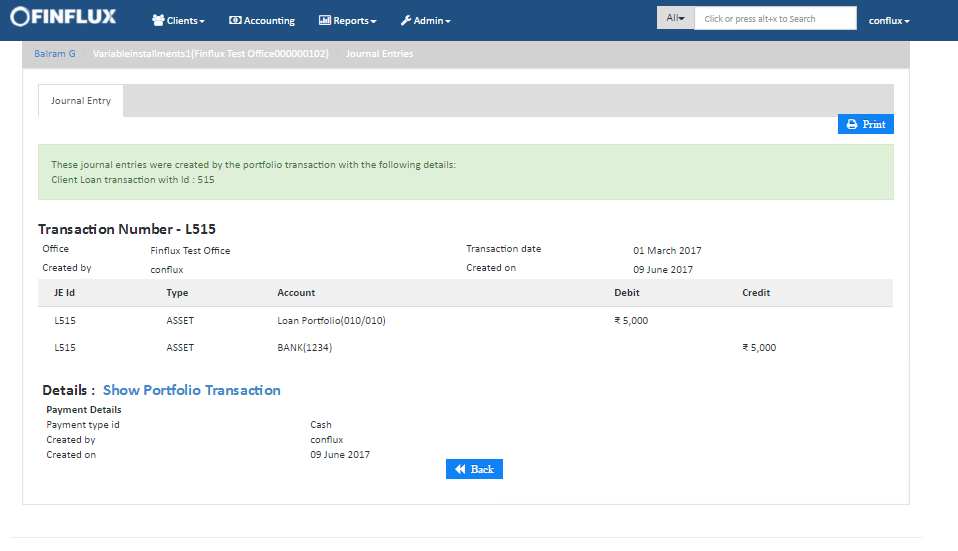

Portfolio generated Journal Entries

Finflux automatically logs journal entries for all relevant portfolio events like

- Loan disbursals

- Loan repayments

- Loan Write-Off

- Loan repayment adjustments

- Loan accrual

- Savings deposit

- Savings withdrawal etc

These journal entries link back to the entity and the transaction that generated them (the loan repayment etc, so that a user can audit automated journal entries in the system)

These journal entries may only be altered with events generating from the portfolio (Ex: a user reverts a loan disbursal etc.)

The rules governing the generation of automated journal entries are linked to each loan and savings product

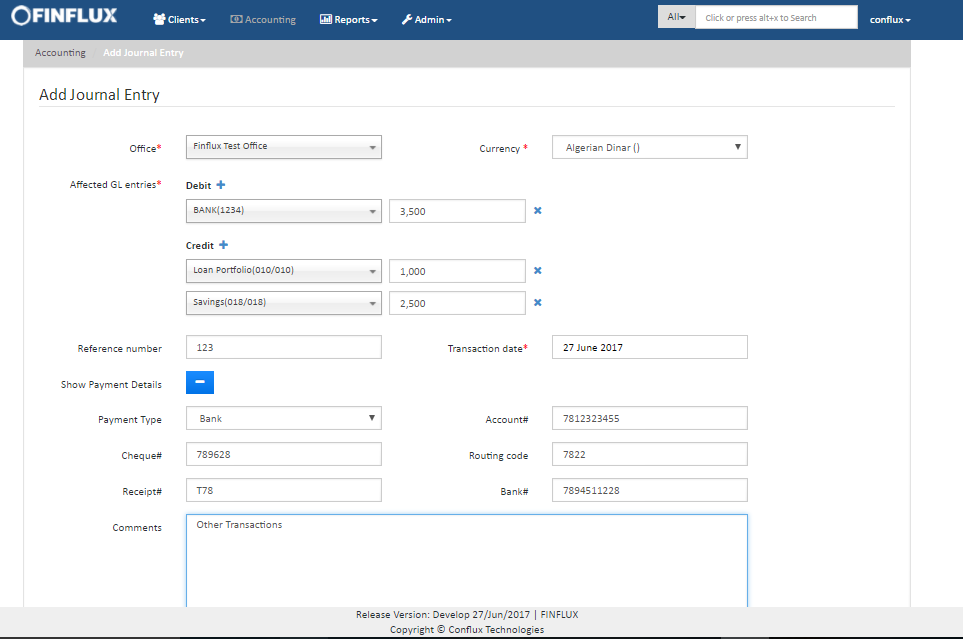

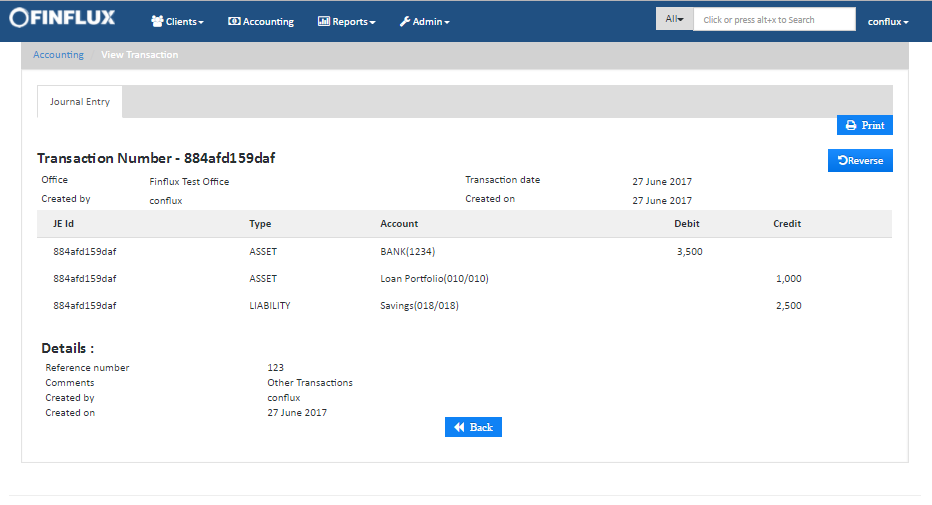

Manual Journal Entries

Finflux allows both simple and compound journal entries, as long as the sums of all debits and credits match. Unlike portfolio generated journal entries, manual journal entries can be reversed (the system automatically logs reversal entries of corresponding debits and credits)

Creation of manual journal entries is documented at Add Journal Entries.

In scenarios where tighter control is required over the accounts against which a particular user or role can create manual journal entries, Finflux provides the abstraction of Accounting Voucher for common activities like Cash Payment, Cash Receipt , Bank Payment, Bank Receipt, JV Entry, Contra Entry, Inter-Branch Cash Transfer and Inter-Branch Bank Transfer. Using Accounting vouchers, fine grained control can be provided over creation of manual journal entries

Users can search for any journal entries in the system following the documentation at Searching Accounting Transactions

Accounting rules for Loans

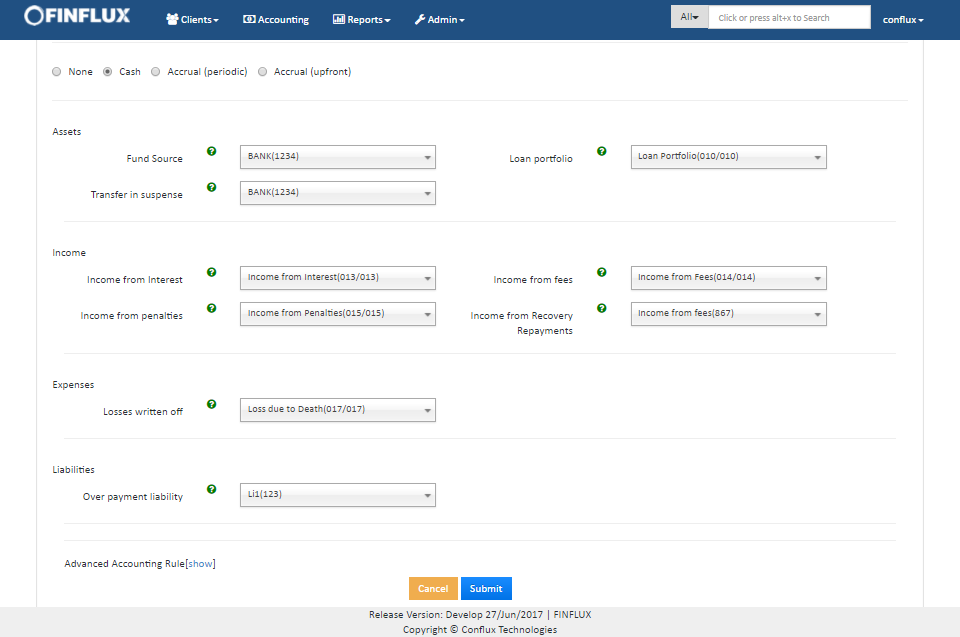

Finflux supports both Cash based and Accrual based accounting based on GAAP standards

Cash based

COA Snippet

The following account placeholders at the product level are mapped with actual accounts from the organizations COA

HEAD | Placeholder |

Assets | Fund Source |

| Loan Portfolio | |

| Transfers in Suspense | |

Income | Income from Interest |

Income from fees | |

Income from Penalties | |

Expenses | Losses Written Off |

| Liability | Overpayment Liability |

Posting Rules

Event | Debit | Credit |

Disbursal | Loan Portfolio | Fund Source |

Principal repayment | Fund Source | Loan Portfolio |

Interest repayment | Fund Source | Income from Interest |

Principal Write off | Losses Written Off | Loan Portfolio |

Fees payment | Fund Source | Income from fees |

Penalty payment | Fund Source | Income from Penalties |

| Initiate Transfer (From Branch A to Branch B) | Transfers in Suspense | Loan Portfolio |

| Accept Transfer (In Branch B) | Loan Portfolio | Transfers in Suspense |

| Over payment | Fund Source | Overpayment Liability |

| Refund (of Overpaid amount) | Overpayment Liability | Fund Source |

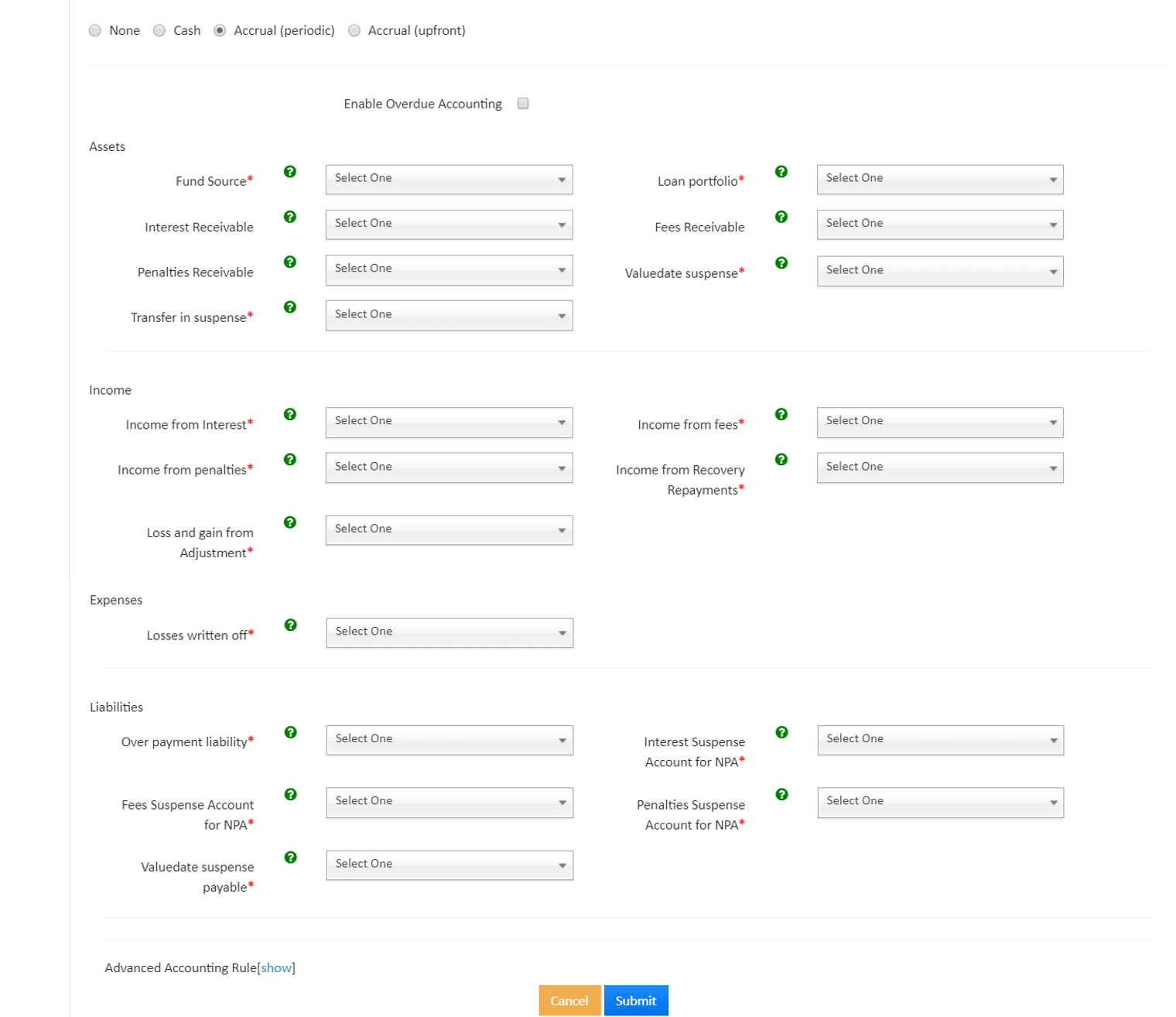

Accrual Based

COA Snippet

When using accrual based accounting, the receivables are also accounted for as shown in the below scenario

HEAD | Placeholder |

Assets | Fund Source |

Loan Portfolio | |

Interest Receivables | |

Fees Receivables | |

Penalties Receivables | |

| Valuedate Suspense | |

| Transfer in Suspense | |

INCOME | Income from Interest |

Income from fees | |

Income from Penalties | |

| Income from Recovery Repayments | |

| Loss and Gain from Adjustment | |

Expenses | Losses Written Off |

| Liabilities | Over Payment Liability |

| Interest Suspense Account for NPA | |

| Fees Suspense Account for NPA | |

| Penalties Suspense Account for NPA | |

| Value date Suspense Payable |

Posting Rules

Event | Debit | Credit |

Disbursal | Loan Portfolio | Fund Source |

Interest Applied | Receivables Interest | Income from Interest |

Fee Applied | Fees Receivable | Income from fees |

Penalty Applied | Penalties Receivable | Income from Penalties |

Principal repayment | Fund Source | Loan Portfolio |

Interest repayment | Fund Source | Receivables Interest |

Principal Write off | Losses Written Off | Loan Portfolio |

Fees payment | Fund Source | Fee Receivable |

Penalty payment | Fund Source | Penalties Receivable |

Interest write off | Losses Written Off | Interest Receivable |

Fee write off | Losses Written Off | Fee Receivable |

Penalty write off | Losses Written Off | Penalties Receivable |

| Penalty on NPA | Income from Penalties | Penalties Suspense account for NPA |

| Fees on NPA | Income from Fees | Fees Suspense account for NPA |

| Interest on NPA | Income from Interest | Interest Suspense Account for NPA |

| External Disbursal Instrument (like NACH) | Valuedate Suspense | Valuedate Suspense Payable |

| External Collection Instrument (like PDC) | Valuedate Suspense Payable | Valuedate Suspense |

| Rounding off Installment in multiples ( 10,50 ,100 etc) | Fund Source | Loss and Gain from Adjustment |

Here is an example of the accounting entries generated over the life cycle of the loan

Event | Debit | Credit |

Disbursal (7-10-2012) | Portfolio Control Account (1) | Fund (1) |

Automated System Event (when an Interest repayment becomes due) (7-11-2012) | Interest Receivable (2) | Income from interest (2) |

Principal, Interest Repayment(1st Installment) (7-11-2012) | Fund (3) | Interest Receivable (3) |

Portfolio Control Account (3) | ||

Prepayment for remaining Instalment’s (no interest accrued) (7-11-2012) | Fund (4) | Portfolio Control Account(4) |

More elaborate examples can be found at Accounting for NPA

Finflux provides the option for Month end closing and year end closing at a branch level (basically a bulk “apply accrued interest” till date job for all loans)

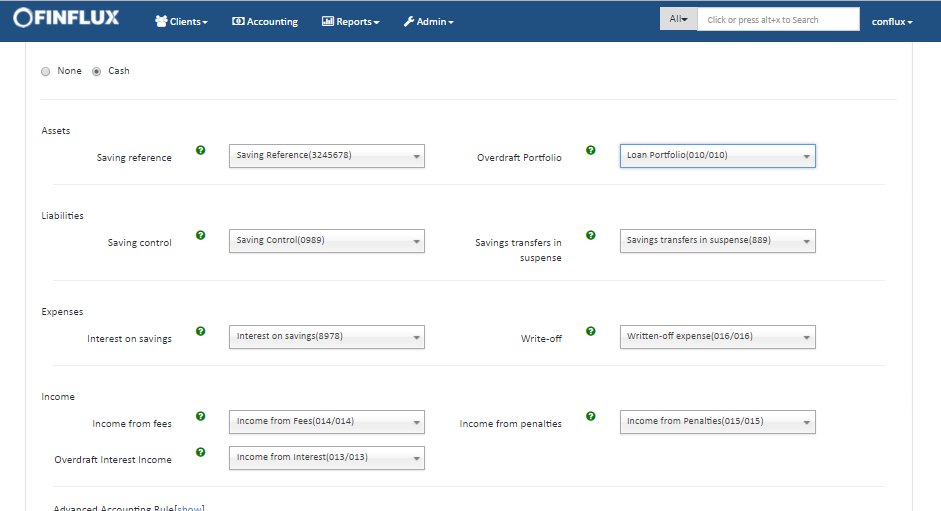

Accounting rules for Savings

The accounting behaviour for savings is as follows

COA Snippet

HEAD | Placeholder |

Assets | Savings Reference |

Income | Income from fees |

Income from Penalties | |

Expenses | Interest for Savings |

| Liability | Savings Control |

| Transfers in Suspense |

Posting Rules

Event | Debit | Credit |

Deposit | Savings Reference | Savings Control |

Withdrawal | Savings Control | Savings Reference |

Interest posting | Interest for Savings | Savings Control |

Fees payment | Savings Control | Income from fees |

Penalty payment | Savings Control | Income from Penalties |

| Initiate Transfer (From Branch A to Branch B) | Savings Control | Transfers in Suspense |

| Accept Transfer (In Branch B) | Transfers in Suspense | Savings Control |

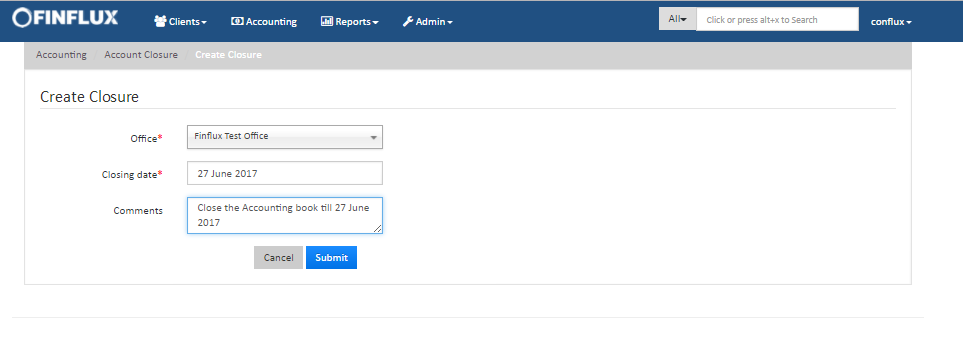

Accounting Closures

Finflux allows setting closure dates at branch level, after which accounting transactions cannot be posted into the system

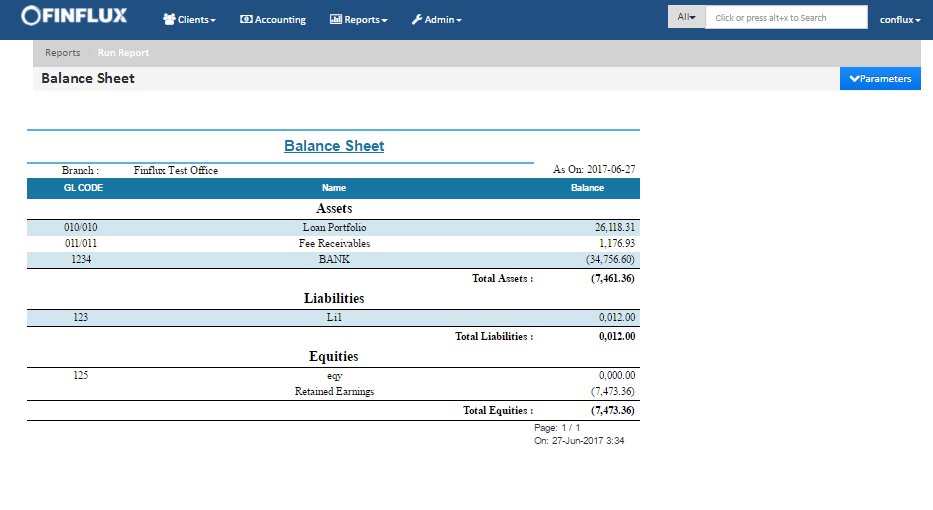

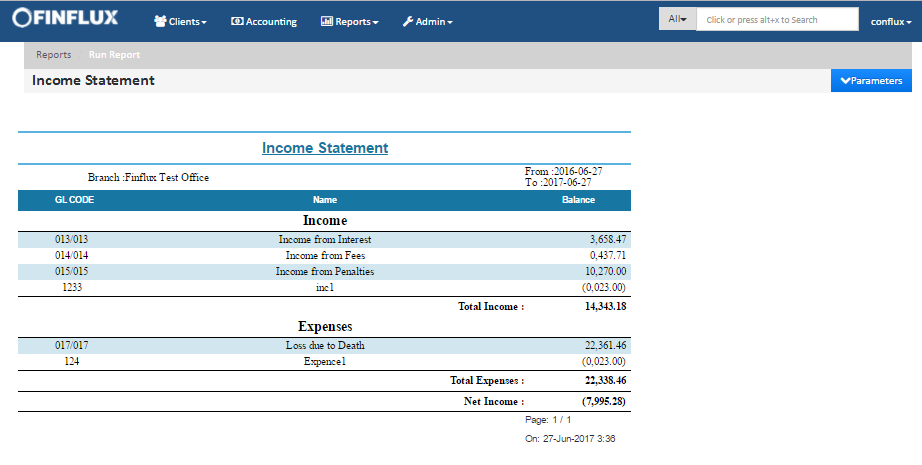

Reports

Of the accounting reports provided by Finflux, the three most commonly used are

- Balance sheet

- Profit and Loss Statement

- Trial balance

Balance Sheet

A balance sheet summarizes an organization or individual's assets, equity and liabilities at a specific point in time.

Formula : Assets = Liabilities + Equity

Income Statement (P & L statement)

Is a company's financial statement that indicates how the revenue (money received from the sale of products and services before expenses are taken out) is transformed into the net income (the result after all revenues and expenses have been accounted for, also known as Net Profit ).

It displays the revenues recognized for a specific period, and the cost and expenses charged against these revenues

Formula: Net Income = Total Income – Total Expenses

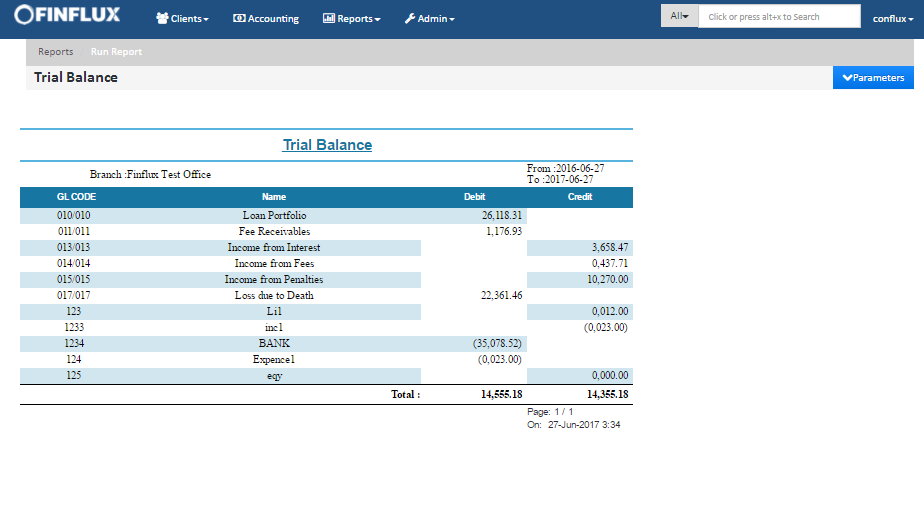

Trial Balance

A trial balance is a list of all the General ledger accounts (both revenue and capital) contained in the ledger of a business.

This list will contain the name of the nominal ledger account and the value of that nominal ledger account.The value of the nominal ledger will hold either a debit balance value or a credit balance value.

The debit balance values will be listed in the debit column of the trial balance and the credit value balance will be listed in the credit column.