How to create new loan - Interest Recalculation

Beginning at the main screen, select Admin, then Products from the drop-down menu. This will launch the Products menu.

Select Loan Products.

Create Loan Product

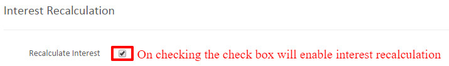

Provide all the required input for the Loan Product Fields, also refer link:- Loan Products

| ||

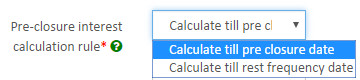

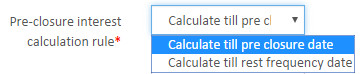

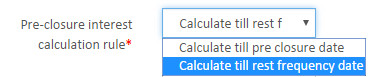

Pre-closure interest calculation rule:- This defines till when the interest should calculate on the event of pre closure. Calculate till pre closure date - On selecting this will calculate interest till as on closing date. For example - suppose Loan closing date is on 20th,feb so will calculate interest till 20th, feb. Calculate till rest frequency date - On selecting this will calculate interest till the rest period. For example - suppose Loan closing date is on 20th,feb so will calculate interest till 30th, feb. | Advance payments adjustment type:- This defines on the event of advance payments how the repayments should get adjusted. Reduce EMI amount - Will reduce EMI amount on the advance payments. Reduce number of installments - Will reduce number of installments on the advance payments. Reschedule next repayments - Will reschedule to next repayments. | |

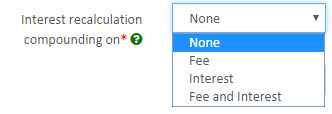

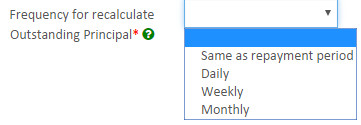

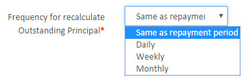

Interest recalculation compounding on:- None - Compounding will not happen, only interest recalculation will happen. Fee - Compounding will happen on fee. Interest - Compounding will happen on interest. Fee and Interest - Compounding will happen on fee and interest. | Frequency for recalculate Outstanding principal:- Once the client makes advance repayments, his outstanding principal may be recalculated on a weekly, fortnightly, monthly or quarterly basis, thereby reducing the weekly, fortnightly, monthly outstanding balance. | |

Frequency interval for recalculation:- This field accompanies the 'Frequency for recalculate outstanding principle'. Ex:- Selecting the interval as 1 and the frequency as monthly, would result in the outstanding balance(reduction) being calculated for every month. | Frequency Date for recalculation:- The date on which reduced outstanding balance will be calculated. | |

Is Arrears recognition based on original schedule:- | Makes sure "Calculate interest for exact days in partial period" is Checked boxed | |

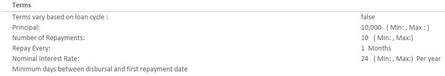

Loan production definition

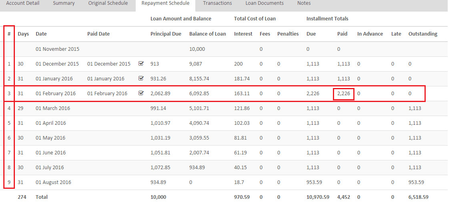

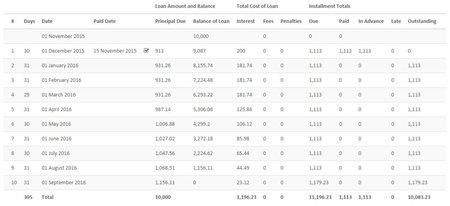

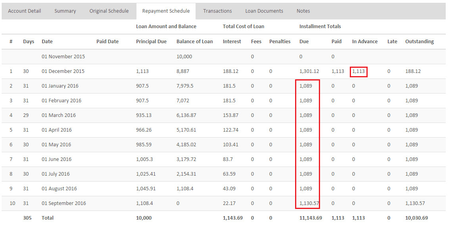

| Original repayment schedule remains same for all the examples. I.e Loan disbursement on 1st,Nov,2015. Repaid every 1 month for 10 months. |

|---|---|

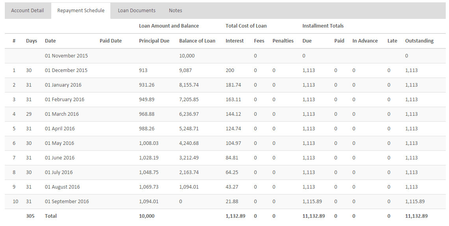

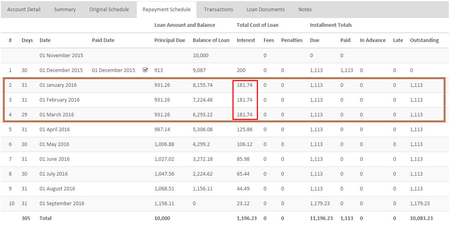

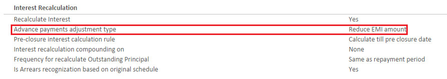

| Scenario 1 - With below mentioned interest recalculation definition | Scenario 1 - Showing example of late repayment. Client makes on time repayment for 1st installment i.e on 1st Dec. So for the unpaid on time installments i.e for Jan,Feb and March interest has recalculated as shown in the below screen shot example. |

|---|---|

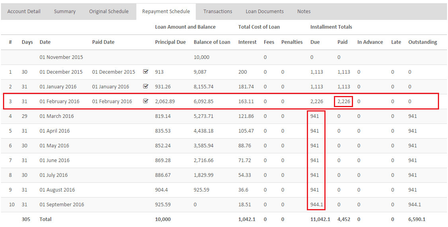

Scenario 2 - On advance payment - Should reduce EMI amount With below mentioned interest recalculation definition | Scenario 2 - Showing example of Advance repayment - Should reduce EMI amount Client makes on time repayment for 1st and 2nd installment i.e for 1st Dec and 1st Jan. And makes an advance payment as on 1st,feb(3rd installment). So for the remaining installments EMI amount gets reduced. |

|---|---|

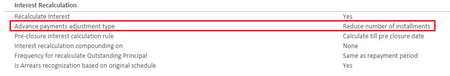

Scenario 3 - On advance payment - Reduce number of installments, With below mentioned interest recalculation definition, | Scenario 3 - Showing example of Advance repayment - Reduce number of installments, Client makes on time repayment for 1st and 2nd installment i.e for 1st Dec and 1st Jan. And makes an advance payment as on 1st,feb(3rd installment). So number of installments gets reduced to 9, instead of 10. |

|---|---|

Scenario 4 - On advance payment - Reschedule next repayments With below mentioned interest recalculation definition, | Scenario 4 - Showing example of Advance repayment - Reschedule next repayments Client makes on time repayment for 1st and 2nd installment i.e for 1st Dec and 1st Jan. And makes an advance payment as on 1st,feb(3rd installment). So number of installments gets rescheduled |

|---|---|

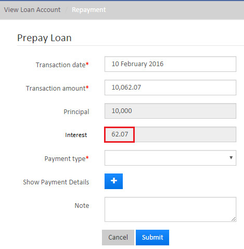

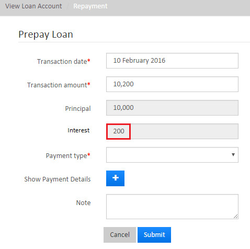

Scenario 5: Pre closing the loan with using pre-closure rule as:- Calculate till pre closure date | Scenario 6: Pre closing the loan with using pre-closure rule as:- Calculate till pre closure date |

|---|---|

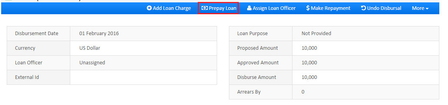

Loan product definition remains same as mentioned above, but in this example: Disbursement is done on - 1st, Feb, 2016 | Loan product definition remains same as mentioned above, but in this example: Disbursement is done on - 1st, Feb, 2016 |

Click on Prepay loan button | Click on Prepay loan button |

In this example prepaying loan on 10th feb,2016. Interest calculation is for - 10 days only, i.e till the pre closure date. | In this example prepaying loan on 10th feb,2016. Interest calculation is for the whole month, i.e till rest frequency period. Note:- Frequency for recalculate Outstanding Principal

|

Scenario 7: Frequency for recalculate outstanding principal:- Same as repayment period | Scenario 8: Frequency for recalculate outstanding principal:Daily Frequency interval for recalculation: 1 Frequency date for recalculation: Before disbursement date. |

|---|---|

Key Error Messages

Related articles