Cash Flow

Bob as a lender has a requirement for analyzing the cash flow of his client before disbursing the loan. Say for an example Bob has a client "Sangeetha" whose occupation is "Animal Husbandry" of Cow and Goat earns an income of 10000 and 5000 respectively and an expense of 1000 and 500 respectively. She also has one house as an asset and earns 10000 by renting her house. She has medical expense of 2000 every month. So Bob want to update all the cash flow details of Sangeetha to analyse her gross income and expense to lend a loan.

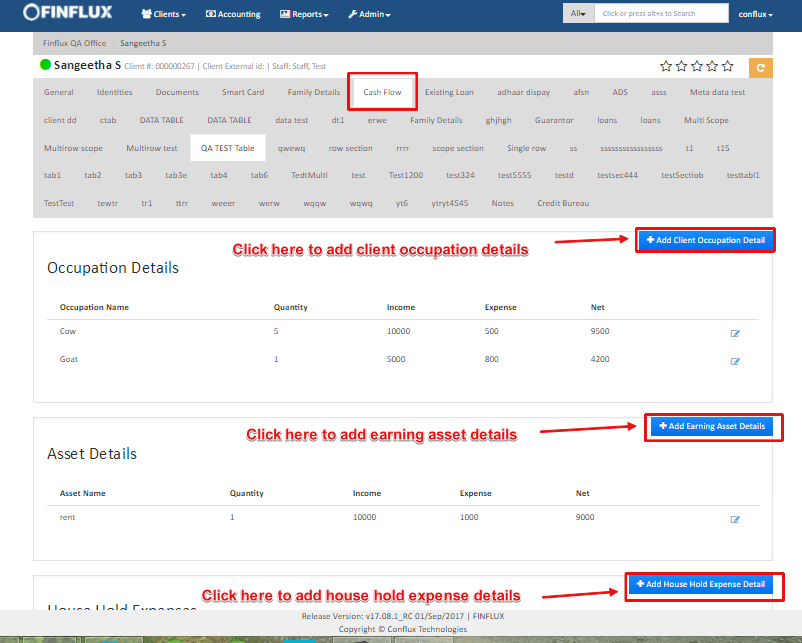

Step 1: Cash Flow overview

Go to Client home screen and click on "Cash Flow" which land on the screen as shown in the fig 1.

| # | Cash Flow Details | Description |

|---|---|---|

| 1. | Client Occupation Details | Click on Add Client Occupation Details to add occupation details. Refer Occupation for configuring occupation and their category |

| 2. | Earning Asset Details | Click on Add Earning Asset Details to add assets details. Refer Income Generating Asset for configuring Earning Assets and their category |

| 3. | House Hold Expense Details | Click on Add House Hold Expense Details to add house hold expenses. Refer House Hold Expense for configuring house hold expense and their category |

Fig 1: Cash Flow

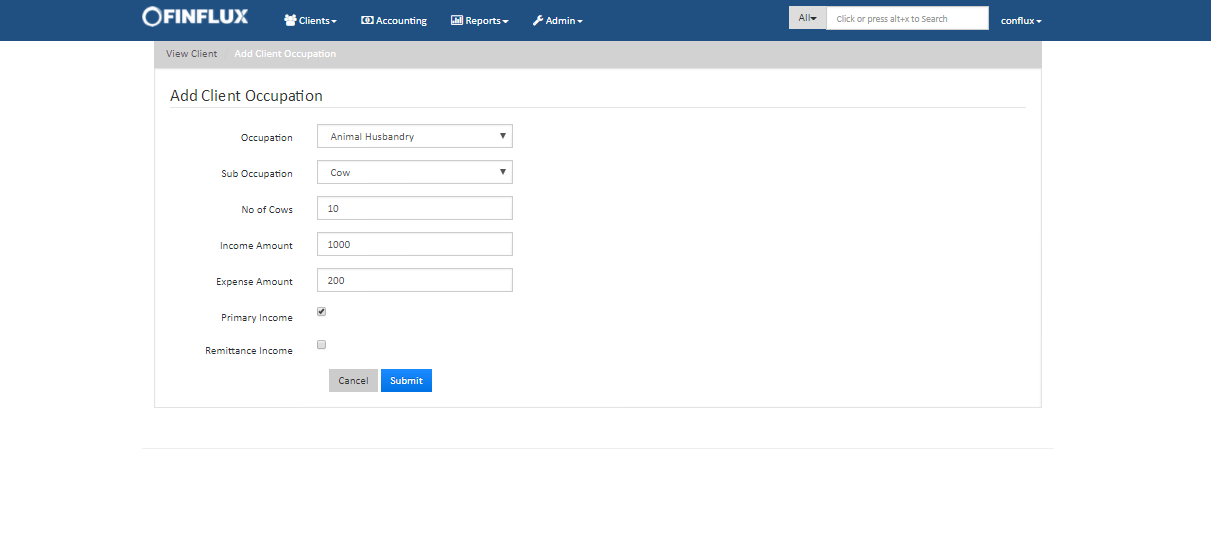

Step 2: Add Client Occupation

Clicking on "Add Client Occupation Details" button will land on the screen as shown in the fig 2.

| # | Field Name | Field Description |

|---|---|---|

| 1. | Occupation | Select the Occupation here. Eg: Animal Husbandry |

| 2. | Sub Occupation | Select the sub-occupation here. Eg: Cow,Goat, Poultry etc |

| 3. | No of Cows | Enter the number of counts here as per the Occupation definition |

| 4. | Income Amount | Enter the Income amount earned |

| 5. | Expense Amount | Enter the expense amount spent |

| 6. | Primary Income | Select the check box if the occupation is primary income source |

| 7. | Remittance Income | Select the check box if the occupation is remittance income source |

Fig 2: Add Client Occupation

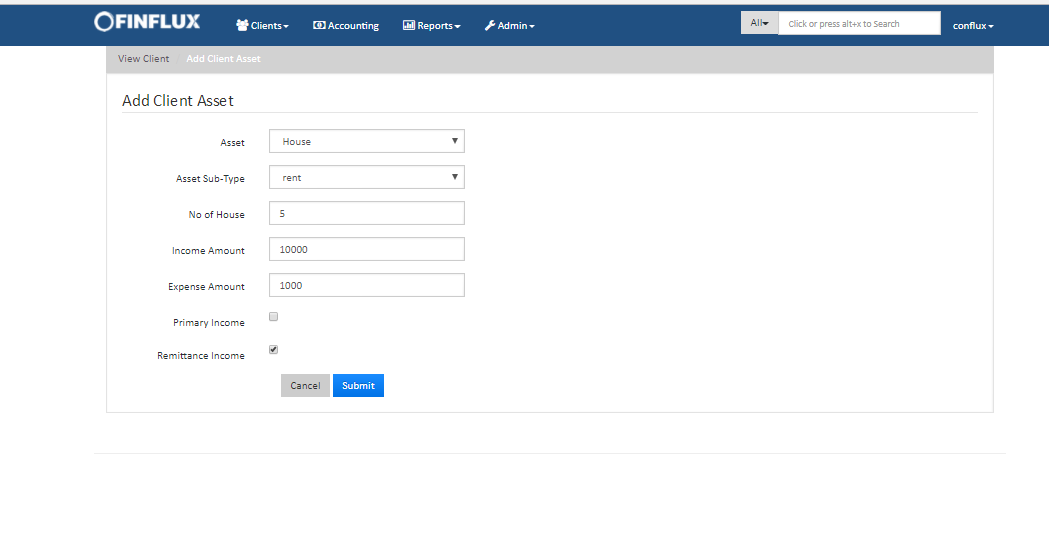

Step 3: Add Client Asset

Clicking on "Add Earning Asset Details" button will land on the screen as shown in the fig 3.

| # | Field Name | Field Description |

|---|---|---|

| 1. | Asset | Select the Asset here. Eg: House, Factory |

| 2. | Asset Sub-Type | Select the Asset Sub-Type here. Eg: Rent etc |

| 3. | No of House | Enter the number of counts here as per the Income Generating Asset Definition |

| 4. | Income Amount | Enter the Income amount earned |

| 5. | Expense Amount | Enter the expense amount spent |

| 6. | Primary Income | Select the check box if the occupation is primary income source |

| 7. | Remittance Income | Select the check box if the occupation is remittance income source |

Fig 3: Add Client Asset

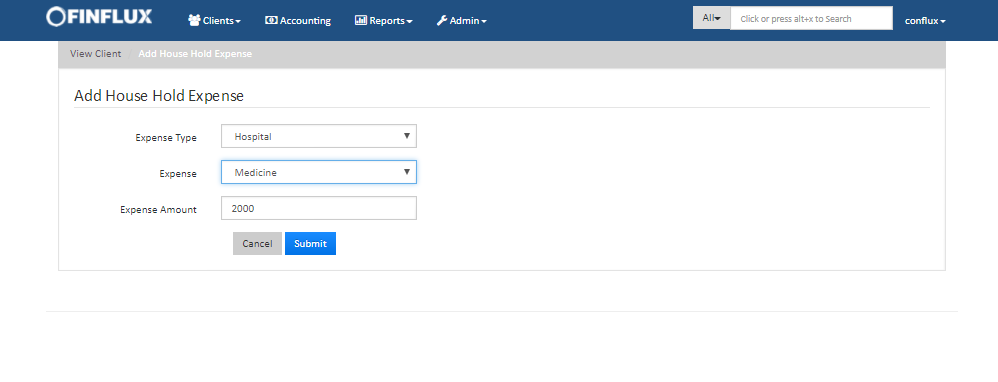

Step 4: Add House Hold Expense

| # | Field Name | Field Description |

|---|---|---|

| 1. | Expense Type | Select the Expense type here.Refer House hold Expense for more info. Eg: Hospital |

| 2. | Expense | Select the expense(expense category) here. Eg: Medicines, Doctor Consultation Fee etc., |

| 3. | Expense Amount | Enter the expense amount here. |

Fig 4: Add House hold expense

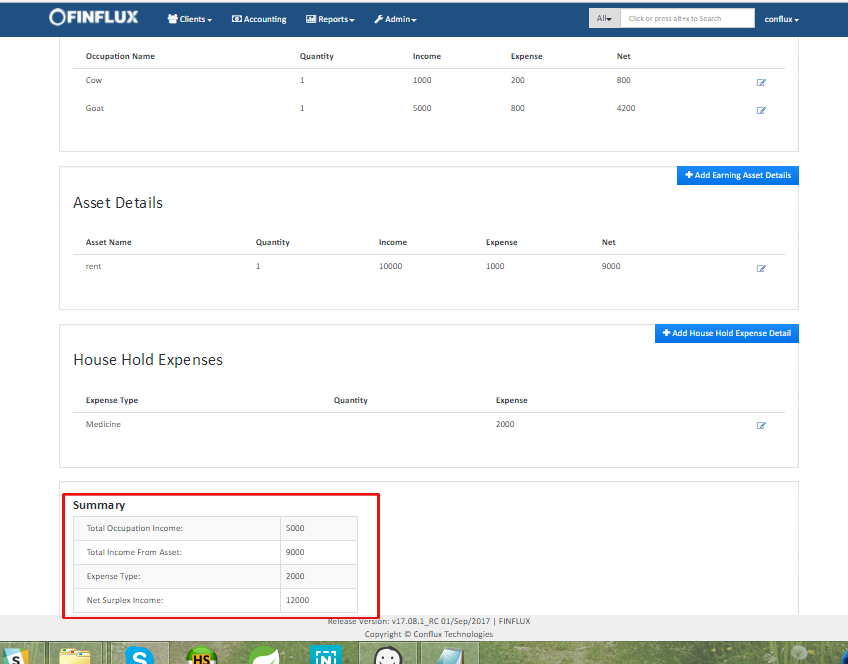

Step 5: Cash Flow Overview

After updating all the details view on the cash flow summary screen where total income, expense and surplex income as calculated for the better analysis of client's cash flow.

Fig 5: View Cash Flow Summary